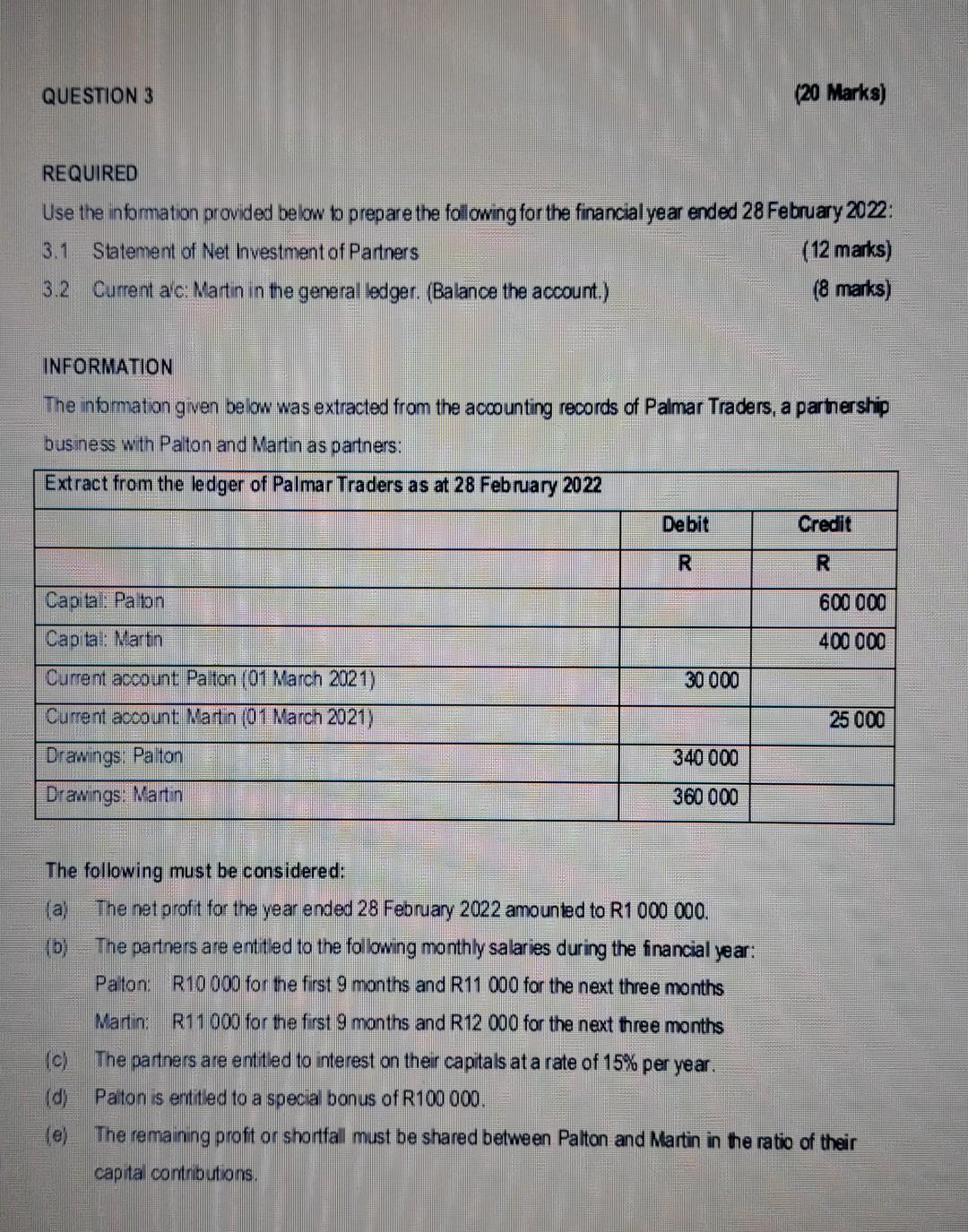

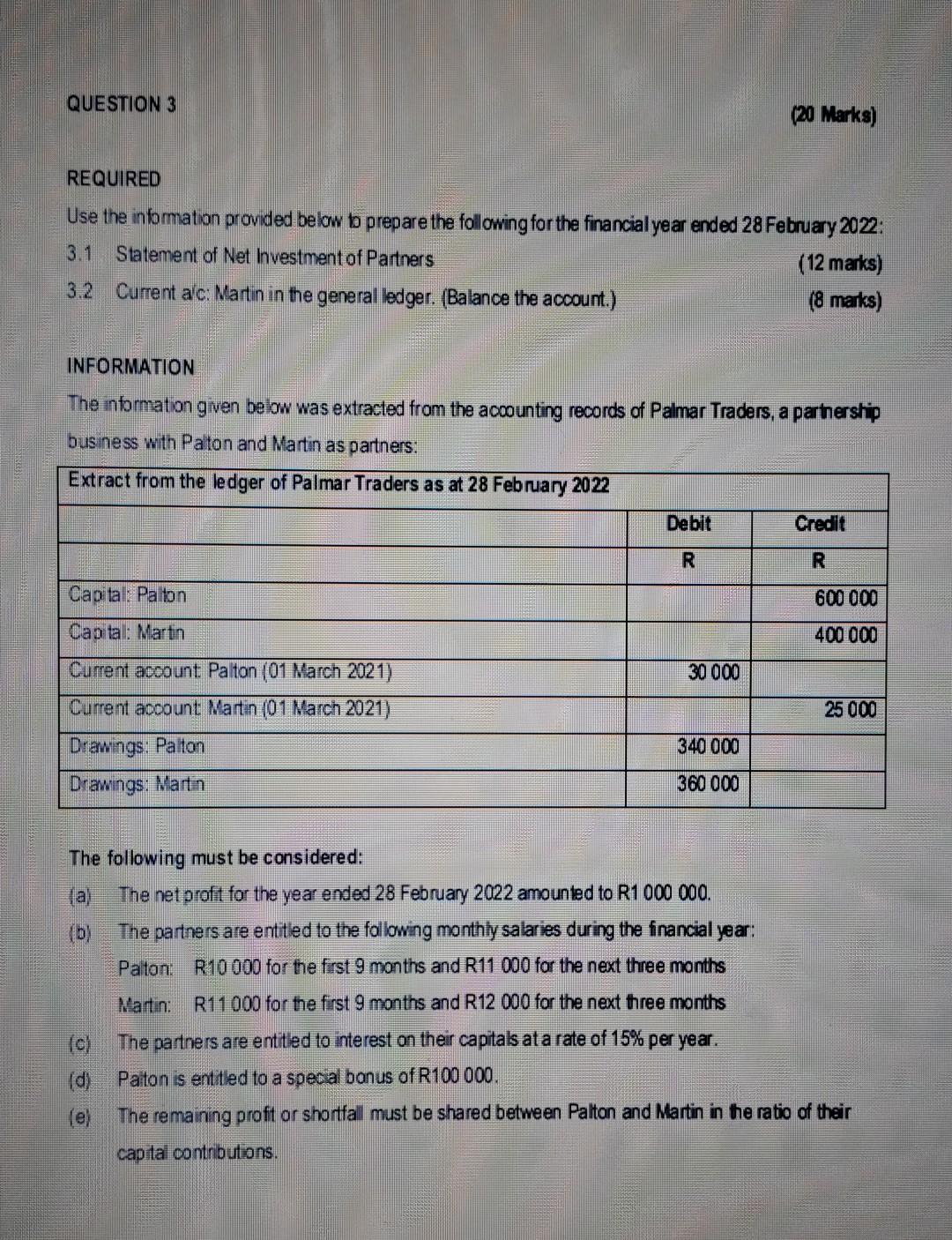

Question: Question 3 REQUIRED Use the information provided below to prepare the following for the financial year ended 28 February 2022 : 3.1 Statement of Net

Question 3

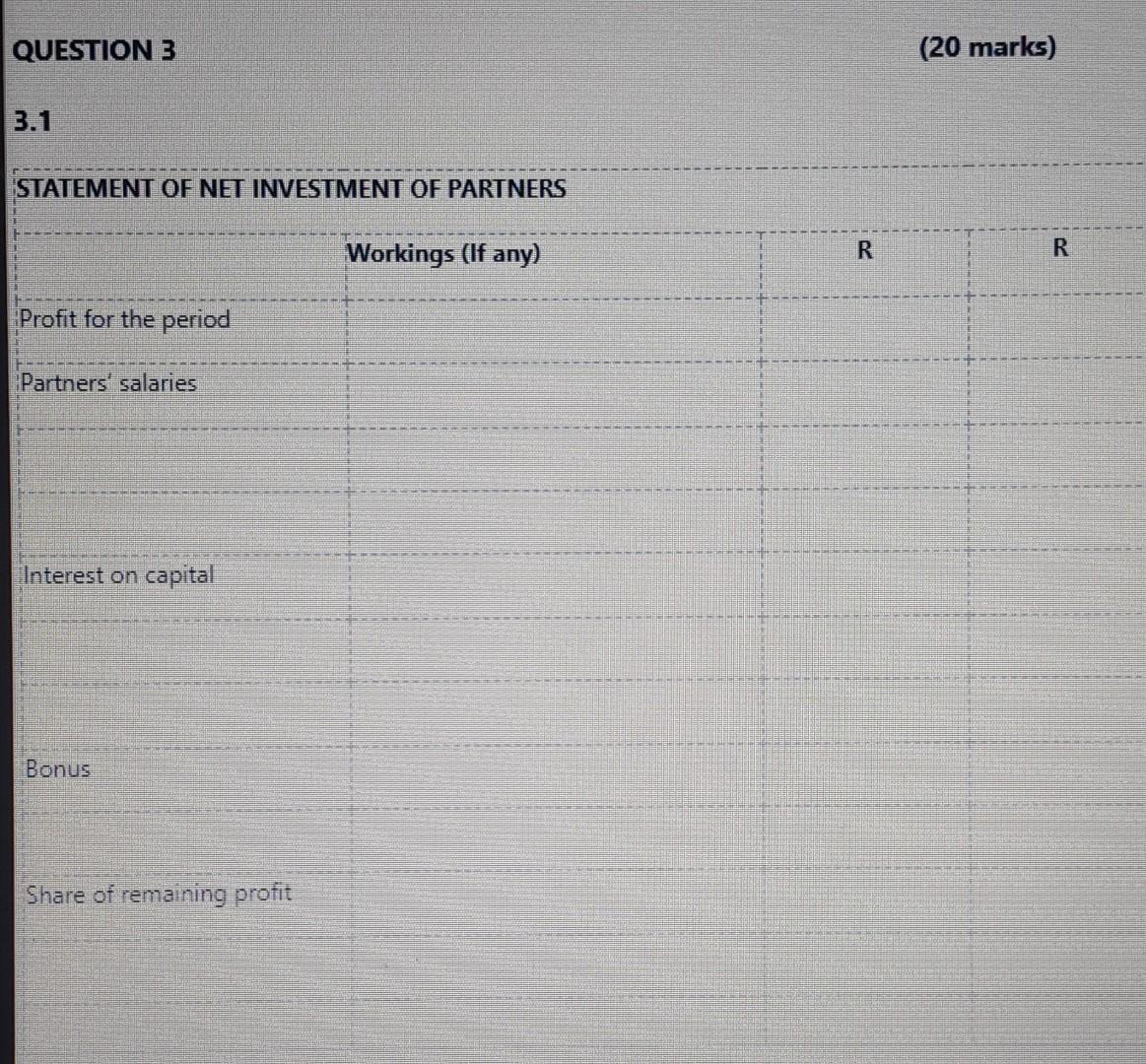

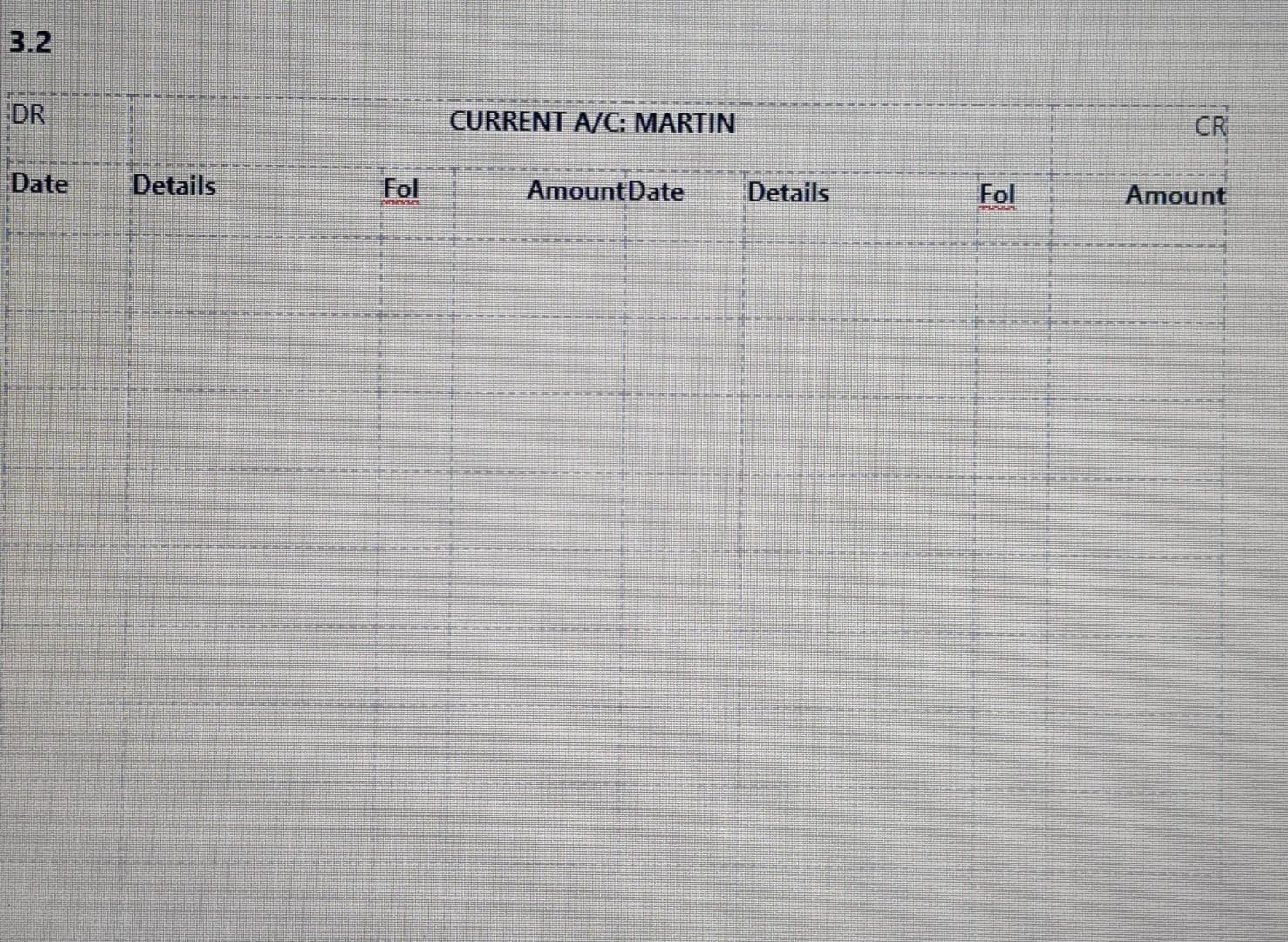

REQUIRED Use the information provided below to prepare the following for the financial year ended 28 February 2022 : 3.1 Statement of Net Investment of Partners (12 marks) 3.2 Current ac: : Nartin in the general ledger. (Balance the account.) (8 marks) INFORMATION The information given below was extracted fram the accounting records of Palmar Traders, a parthership business with Paton and Martin as partners: The following must be considered: (a) The net profit for the year ended 28 February 2022 amounted to R1 000000. (b) The partners are entitled to the following monthly salaries during the financial year: Paiton: R10 000 for the first 9 months and R11 000 for the next three months Martin: R11 000 for the first 9 manths and R12 000 for the next three months (c) The partners are entitied to interest on their capitals at a rate of 15% per year. (d) Paton is entitiled to a special bonus of R100000. (e) The remaining proft or shorffall must be shared between Palton and Martin in the ratio of their capital contributions. QUESTION 3 (20 marks) 3.1 STATEMENT OF NET INVESTMENT OF PARTNERS Partners' salaries Interest on capital Bonus Share of remaining profit 3.2 iDR CURRENT A/C: MARTIN CR Date Details Fol AmountDate Details Fol Amount REQUIRED Use the information provided below to prepare the following for the financial year ended 28 February 2022 : 3.1 Statement of Net investment of Partners (12 marks) 3.2 Current a'c: Martin in the general ledger. (Balance the account.) ( 8 marks) INFORMATION The information given below was extracted from the accoounting records of Palmar Traders, a parhership business with Palton and Martin as partners: The following must be considered: (a) The net profit for the year ended 28 February 2022 amounted to R1000000. (b) The partners are entitled to the fallowing monthly salaries during the financial year: Palton: R10000 for the first 9 manths and R11 000 for the next three months Nartin: R11000 for the first 9 months and R12 000 for the next three months (c) The partners are entitled to interest on their capitals at a rate of 15% per year. (d) Paiton is entited to a special banus of R100000. (e) The remaining proft or shortfall must be shared between Palton and Martin in the ratio of their capital contributions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts