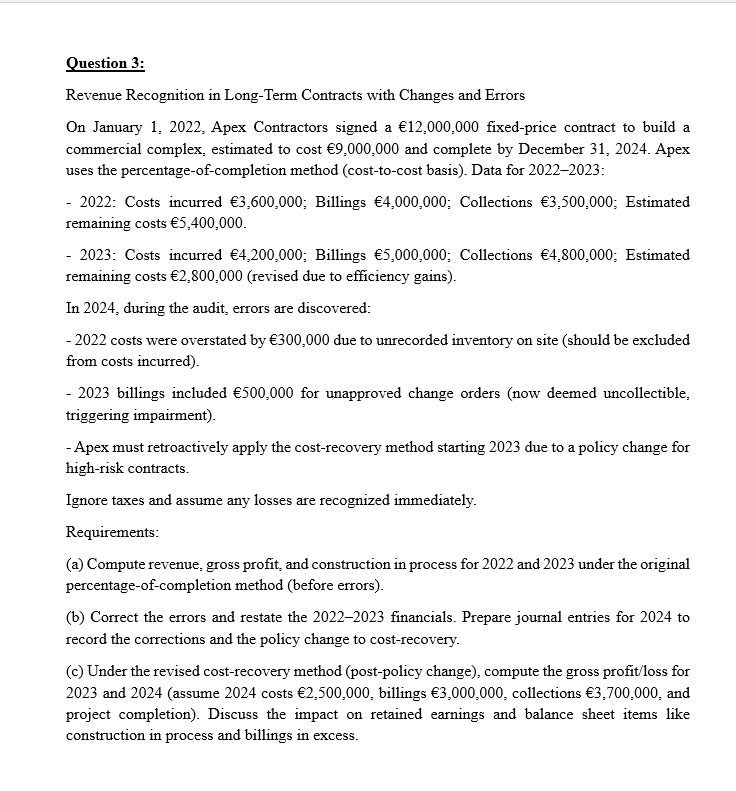

Question: Question 3 : Revenue Recognition i n Long - Term Contracts with Changes and Errors O n January 1 , 2 0 2 2 ,

Question :

Revenue Recognition LongTerm Contracts with Changes and Errors

January Apex Contractors signed fixedprice contract build

commercial complex, estimated and complete December Apex

uses the percentagecompletion method basis Data for :

: Costs incurred ; Billings ; Collections ; Estimated

remaining costs

: Costs incurred ; Billings ; Collections ; Estimated

remaining costs due efficiency gains

during the audit, errors are discovered:

costs were overstated due unrecorded inventory site excluded

from costs incurred

billings included billings collections and

project completion

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock