Question: Question 3 - Short Case (10 marks) You are employed as a sales representative with a salary of S225,000 a year with no commissions. The

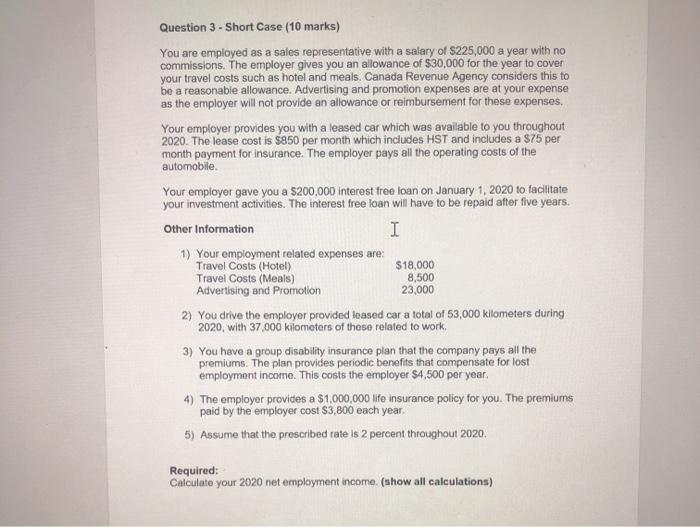

Question 3 - Short Case (10 marks) You are employed as a sales representative with a salary of S225,000 a year with no commissions. The employer gives you an allowance of $30,000 for the year to cover your travel costs such as hotel and meals. Canada Revenue Agency considers this to be a reasonable allowance. Advertising and promotion expenses are at your expense as the employer will not provide an allowance or reimbursement for these expenses, Your employer provides you with a leased car which was available to you throughout 2020. The lease cost is $850 per month which includes HST and includes a $75 per month payment for insurance. The employer pays all the operating costs of the automobile Your employer gave you a $200,000 interest free loan on January 1, 2020 to facilitate your investment activities. The interest free loan will have to be repaid after five years, Other Information I 1) Your employment related expenses are: Travel Costs (Hotel) $18,000 Travel Costs (Meals) 8,500 Advertising and Promotion 23,000 2) You drive the employer provided leased car a total of 53,000 kilometers during 2020, with 37.000 kilometers of these related to work, 3) You have a group disability insurance plan that the company pays all the premiums. The plan provides periodic benefits that compensate for lost employment income. This costs the employer $4,500 per year, 4) The employer provides a $1,000,000 life insurance policy for you. The premiums paid by the employer cost $3,800 each year, 5) Assume that the prescribed rate is 2 percent throughout 2020. Required: Calculate your 2020 net employment income. (show all calculations)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts