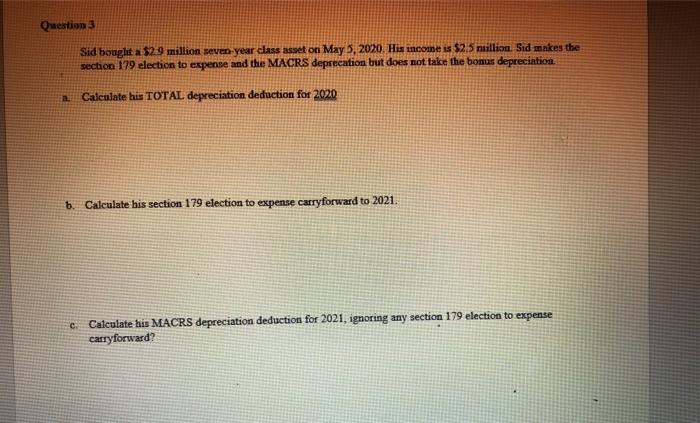

Question: Question 3 Sid bought a $2.9 million seven year class asset on May 5, 2020. His income is $2.5 million. Sid makes the section 179

Question 3 Sid bought a $2.9 million seven year class asset on May 5, 2020. His income is $2.5 million. Sid makes the section 179 election to expense and the MACRS deprecation but does not take the bonus depreciation - Calculate his TOTAL depreciation deduction for 2020 6. Calculate his section 179 election to expense carryforward to 2021. c. Calculate his MACRS depreciation deduction for 2021, ignoring any section 179 election to expense carryforward? Question 3 Sid bought a $2.9 million seven year class asset on May 5, 2020. His income is $2.5 million. Sid makes the section 179 election to expense and the MACRS deprecation but does not take the bonus depreciation - Calculate his TOTAL depreciation deduction for 2020 6. Calculate his section 179 election to expense carryforward to 2021. c. Calculate his MACRS depreciation deduction for 2021, ignoring any section 179 election to expense carryforward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts