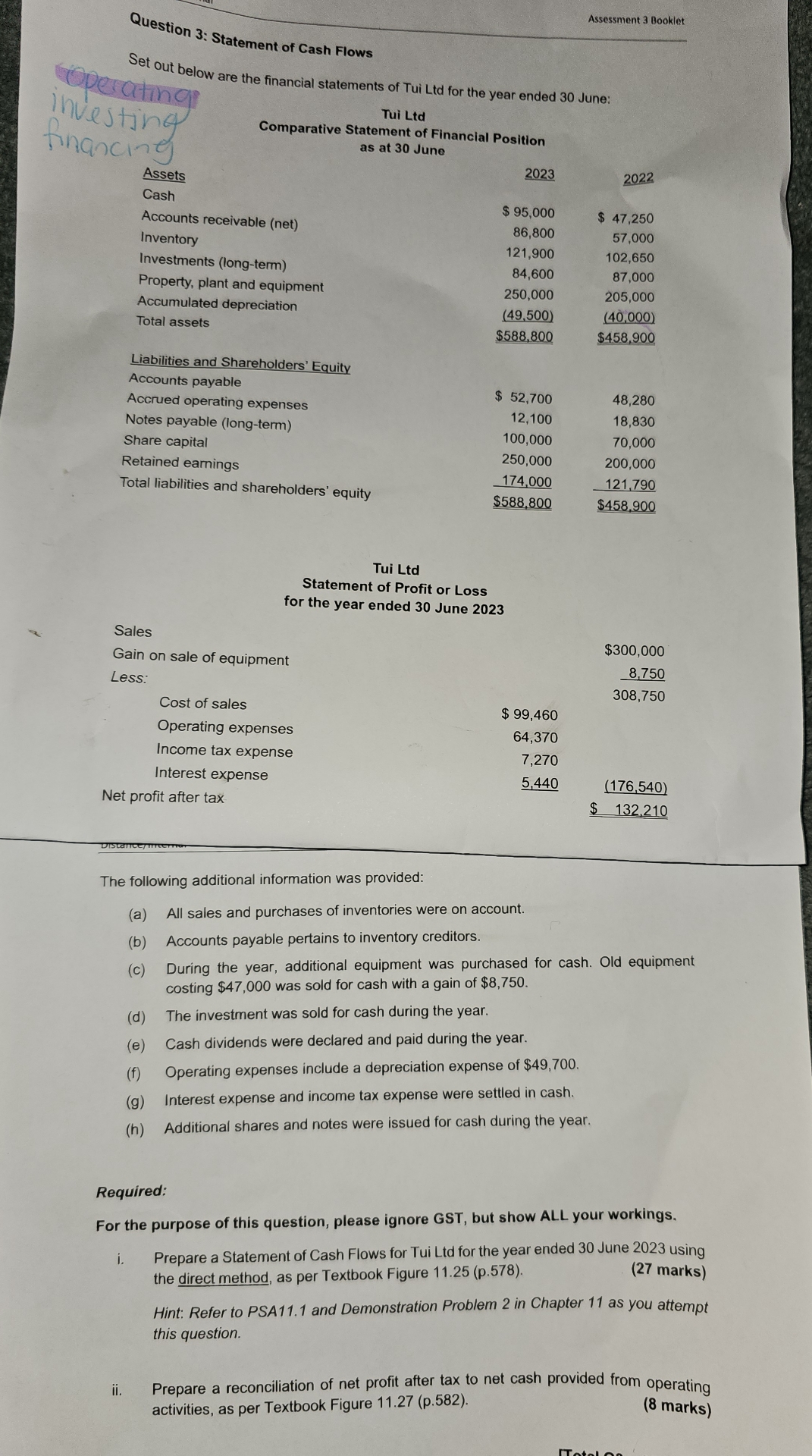

Question: Question 3 : Statement of Cash Flows Set out below are the financial statements of Tui Ltd for the year ended 3 0 June: Tui

Question : Statement of Cash Flows

Set out below are the financial statements of Tui Ltd for the year ended June:

Tui Ltd

Statement of Profit or Loss

for the year ended June

The following additional information was provided:

a All sales and purchases of inventories were on account.

b Accounts payable pertains to inventory creditors.

c During the year, additional equipment was purchased for cash. Old equipment

costing $ was sold for cash with a gain of $

d The investment was sold for cash during the year.

e Cash dividends were declared and paid during the year.

f Operating expenses include a depreciation expense of $

g Interest expense and income tax expense were settled in cash.

h Additional shares and notes were issued for cash during the year.

Required:

For the purpose of this question, please ignore GST but show ALL your workings.

i Prepare a Statement of Cash Flows for Tui Ltd for the year ended June using

the direct method.

ii Prepare a reconciliation of net profit after tax to net cash provided from operating

activities.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock