Question: Question 3 Study the information provided below and calculate the following: 3.1 Manufacturing costs per unit for each product using the traditional absorption costing system

Question 3 Study the information provided below and calculate the following: 3.1 Manufacturing costs per unit for each product using the traditional absorption costing system (6 marks) 3.2 Manufacturing overheads cost per unit for each product using the ABC system. (14 marks)

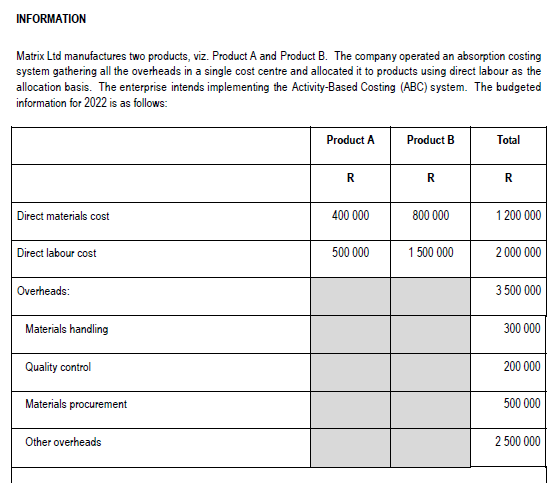

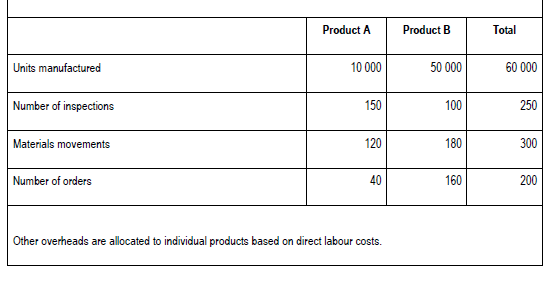

INFORMATION Matrix Ltd manufactures two products, viz. Product A and Product B. The company operated an absorption costing system gathering all the overheads in a single cost centre and allocated it to products using direct labour as the allocation basis. The enterprise intends implementing the Activity-Based Costing (ABC) system. The budgeted information for 2022 is as follows: Direct materials cost Direct labour cost Overheads: Materials handling Quality control Materials procurement Other overheads Product A R 400 000 500 000 Product B R 800 000 1 500 000 Total R 1 200 000 2 000 000 3 500 000 300 000 200 000 500 000 2 500 000 Units manufactured Number of inspections Materials movements Number of orders Product A 10 000 150 120 40 Other overheads are allocated to individual products based on direct labour costs. Product B 50 000 100 180 160 Total 60 000 250 300 200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts