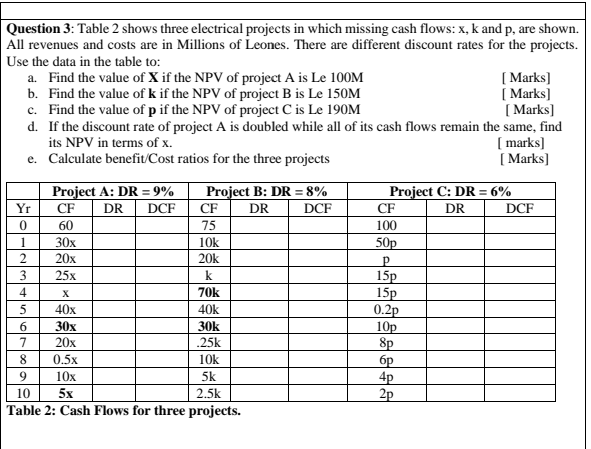

Question: Question 3: Table 2 shows three electrical projects in which missing cash flows: x, k and p, are shown. All revenues and costs are in

Question 3: Table 2 shows three electrical projects in which missing cash flows: x, k and p, are shown. All revenues and costs are in Millions of Leones. There are different discount rates for the projects. Use the data in the table to: a. Find the value of X if the NPV of project A is Le 100M [ Marks) b. Find the value of k if the NPV of project B is Le 150M [ Marks c. Find the value of p if the NPV of project Cis Le 190M [ Marks) d. If the discount rate of project A is doubled while all of its cash flows remain the same, find its NPV in terms of x. [ marks) e. Calculate benefit Cost ratios for the three projects [ Marks) = | Project C: DR = 6% CF DR DCF 100 50p 15p Project A: DR = 9% Project B: DR = 8% Yr CF DR DCF CF DR DCF 0 60 75 1 30x 10K 2 20x 20k 3 25x k 4 70k 5 40x 40k 6 30x 30k 7 20x .25k 8 0.5x 10k 9 10x 5k 10 5x 2.5k Table 2: Cash Flows for three projects. 15p 0.2p 10p 8 . 4p 2p Question 3: Table 2 shows three electrical projects in which missing cash flows: x, k and p, are shown. All revenues and costs are in Millions of Leones. There are different discount rates for the projects. Use the data in the table to: a. Find the value of X if the NPV of project A is Le 100M [ Marks) b. Find the value of k if the NPV of project B is Le 150M [ Marks c. Find the value of p if the NPV of project Cis Le 190M [ Marks) d. If the discount rate of project A is doubled while all of its cash flows remain the same, find its NPV in terms of x. [ marks) e. Calculate benefit Cost ratios for the three projects [ Marks) = | Project C: DR = 6% CF DR DCF 100 50p 15p Project A: DR = 9% Project B: DR = 8% Yr CF DR DCF CF DR DCF 0 60 75 1 30x 10K 2 20x 20k 3 25x k 4 70k 5 40x 40k 6 30x 30k 7 20x .25k 8 0.5x 10k 9 10x 5k 10 5x 2.5k Table 2: Cash Flows for three projects. 15p 0.2p 10p 8 . 4p 2p

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts