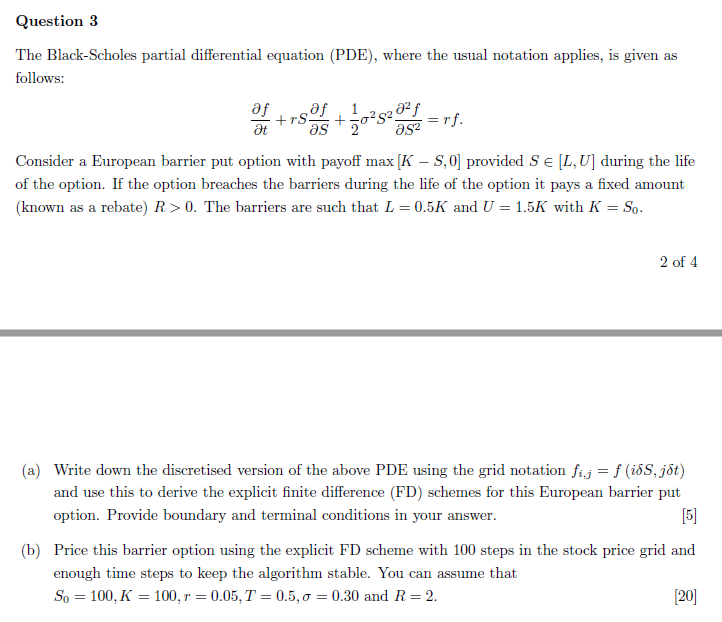

Question: Question 3 The Black-Scholes partial differential equation (PDE), where the usual notation applies, is given as follows: af saf ,1,2528-ferf. t Ersas + 2048 asz=rf.

Question 3 The Black-Scholes partial differential equation (PDE), where the usual notation applies, is given as follows: af saf ,1,2528-ferf. t Ersas + 2048 asz=rf. Consider a European barrier put option with payoff max [K - S, provided S [L, U] during the life of the option. If the option breaches the barriers during the life of the option it pays a fixed amount (known as a rebate) R>0. The barriers are such that L = 0.5K and U = 1.5K with K = So. 2 of 4 (a) Write down the discretised version of the above PDE using the grid notation fij= f (iss, jot) and use this to derive the explicit finite difference (FD) schemes for this European barrier put option. Provide boundary and terminal conditions in your answer. [5] (b) Price this barrier option using the explicit FD scheme with 100 steps in the stock price grid and enough time steps to keep the algorithm stable. You can assume that So = 100, K = 100, r = 0.05, T = 0.5, 0 = 0.30 and R=2. [20] Question 3 The Black-Scholes partial differential equation (PDE), where the usual notation applies, is given as follows: af saf ,1,2528-ferf. t Ersas + 2048 asz=rf. Consider a European barrier put option with payoff max [K - S, provided S [L, U] during the life of the option. If the option breaches the barriers during the life of the option it pays a fixed amount (known as a rebate) R>0. The barriers are such that L = 0.5K and U = 1.5K with K = So. 2 of 4 (a) Write down the discretised version of the above PDE using the grid notation fij= f (iss, jot) and use this to derive the explicit finite difference (FD) schemes for this European barrier put option. Provide boundary and terminal conditions in your answer. [5] (b) Price this barrier option using the explicit FD scheme with 100 steps in the stock price grid and enough time steps to keep the algorithm stable. You can assume that So = 100, K = 100, r = 0.05, T = 0.5, 0 = 0.30 and R=2. [20]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts