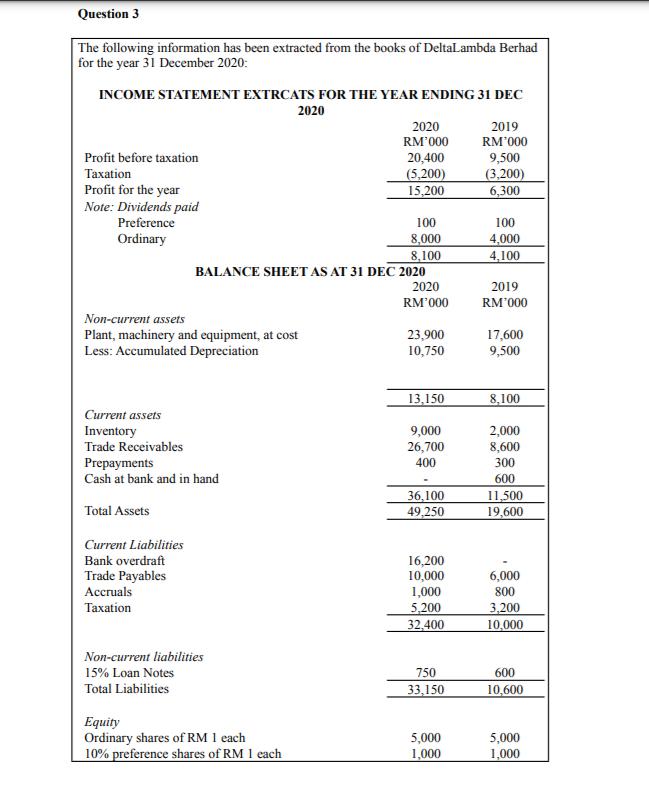

Question: Question 3 The following information has been extracted from the books of DeltaLambda Berhad for the year 31 December 2020: INCOME STATEMENT EXTRCATS FOR

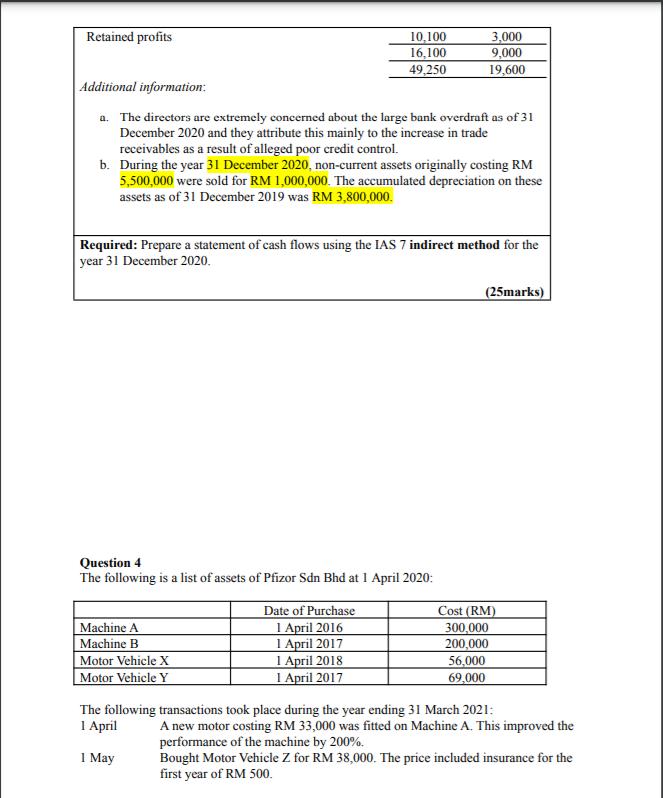

Question 3 The following information has been extracted from the books of DeltaLambda Berhad for the year 31 December 2020: INCOME STATEMENT EXTRCATS FOR THE YEAR ENDING 31 DEC 2020 Profit before taxation Taxation Profit for the year Note: Dividends paid Preference Ordinary Non-current assets Plant, machinery and equipment, at cost Less: Accumulated Depreciation Current assets Inventory Trade Receivables Prepayments Cash at bank and in hand Total Assets Current Liabilities Bank overdraft Trade Payables Accruals Taxation BALANCE SHEET AS AT 31 DEC 2020 2020 RM'000 Non-current liabilities 15% Loan Notes Total Liabilities 2020 RM'000 Equity Ordinary shares of RM 1 each 10% preference shares of RM 1 each. 20,400 (5,200) 15,200 100 8,000 8,100 23,900 10,750 13,150 9,000 26,700 400 36,100 49,250 16,200 10,000 1,000 5,200 32,400 750 33,150 5,000 1,000 2019 RM'000 9,500 (3,200) 6,300 100 4,000 4,100 2019 RM'000 17,600 9,500 8,100 2,000 8,600 300 600 11,500 19,600 6,000 800 3,200 10,000 600 10,600 5,000 1,000 Retained profits 10,100 16,100 49,250 Additional information: a. The directors are extremely concerned about the large bank overdraft as of 31 December 2020 and they attribute this mainly to the increase in trade receivables as a result of alleged poor credit control. b. During the year 31 December 2020, non-current assets originally costing RM 5,500,000 were sold for RM 1,000,000. The accumulated depreciation on these assets as of 31 December 2019 was RM 3,800,000. Required: Prepare a statement of cash flows using the IAS 7 indirect method for the year 31 December 2020. Question 4 The following is a list of assets of Pfizor Sdn Bhd at 1 April 2020: Machine A Machine B Motor Vehicle X Motor Vehicle Y Date of Purchase 1 April 2016 1 April 2017 1 April 2018 1 April 2017 3,000 9,000 19,600 (25marks) Cost (RM) 300,000 200,000 56,000 69,000 The following transactions took place during the year ending 31 March 2021: 1 April 1 May A new motor costing RM 33,000 was fitted on Machine A. This improved the performance of the machine by 200%. Bought Motor Vehicle Z for RM 38,000. The price included insurance for the first year of RM 500. 1 August Bought Machine C, trading in Machine B for RM 112,000, and paying cash of RM 200,000. Pfizor Sdn Bhd depreciates machinery on a straight-line basis over a period of 10 years assuming a nil residual value. Motor vehicles are depreciated using the sum of the years' digit method over a period of 5 years and assuming a nil residual value. It is the company's policy to charge a full year's depreciation on all assets in use at the end of a year irrespective of the date of purchase. Assets sold during a year are not depreciated. a) Prepare the following ledger accounts to record the above transactions in respect of the year ended 31 March 2021: i. Motor vehicles at cost ii. Provision for depreciation on motor vehicles iii. Machinery at cost iv. Provision for depreciation on machinery v. Machinery disposal

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts