Question: Question # 3: The following information is available from ABC Company, 2006 accounting records: Purchases Purchase discounts Beginning inventory Ending inventory Freight out Rs. 530.000

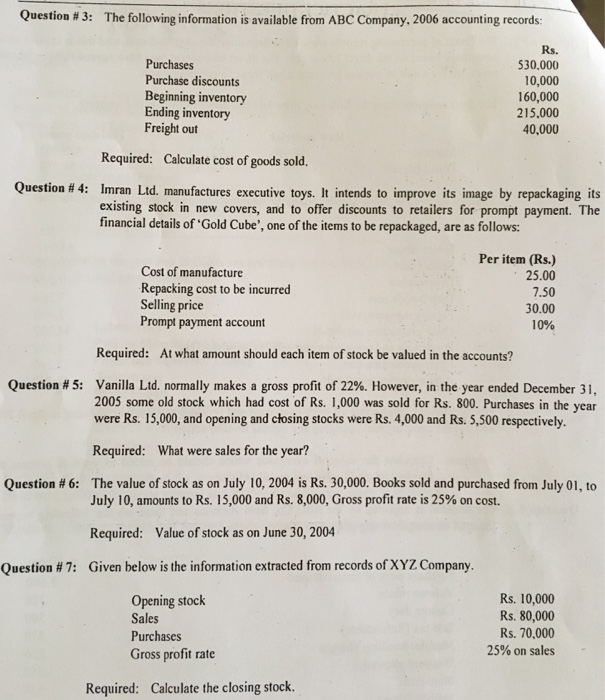

Question # 3: The following information is available from ABC Company, 2006 accounting records: Purchases Purchase discounts Beginning inventory Ending inventory Freight out Rs. 530.000 10,000 160,000 215.000 40,000 Required: Calculate cost of goods sold. Question #4: Imran Ltd. manufactures executive toys. It intends to improve its image by repackaging its existing stock in new covers, and to offer discounts to retailers for prompt payment. The financial details of 'Gold Cube', one of the items to be repackaged, are as follows: Cost of manufacture Repacking cost to be incurred Selling price Prompt payment account Per item (Rs.) 25.00 7.50 0.00 10% Required: At what amount should each item of stock be valued in the accounts? Vanilla Ltd. normally makes a gross profit of 22%. However, in the year ended December 31, 2005 some old stock which had cost of Rs. 1,000 was sold for Rs. 800. Purchases in the year were Rs. 15,000, and opening and ctosing stocks were Rs. 4,000 and Rs. 5,500 respectively. Question # 5: Required: What were sales for the year? The value of stock as on July 10, 2004 is Rs 30,000. Books sold and purchased from July 01, to July 10, amounts to Rs. 15,000 and Rs. 8,000, Gross profit rate is 25% on cost. Question # 6: Required: Value of stock as on June 30, 2004 Question # 7: Given below is the information extracted from records of XYZ Company. Opening stock Sales Purchases Gross profit rate Rs. 10,000 Rs. 80,000 Rs. 70,000 25% on sales Required: Calculate the closing stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts