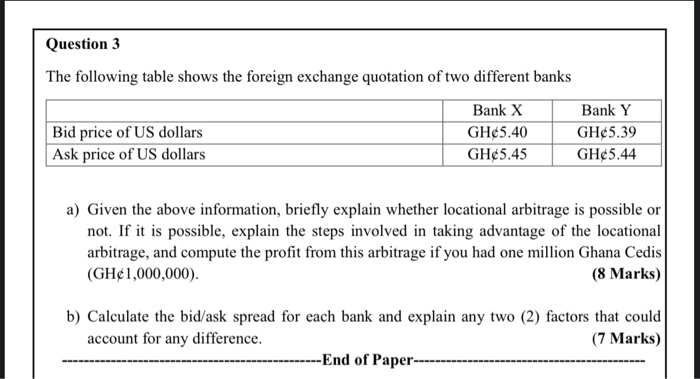

Question: Question 3 The following table shows the foreign exchange quotation of two different banks Bank X Bank Y Bid price of US dollars GH5.40 GH5.39

Question 3 The following table shows the foreign exchange quotation of two different banks Bank X Bank Y Bid price of US dollars GH5.40 GH5.39 Ask price of US dollars GH5.45 GH5.44 a) Given the above information, briefly explain whether locational arbitrage is possible or not. If it is possible, explain the steps involved in taking advantage of the locational arbitrage, and compute the profit from this arbitrage if you had one million Ghana Cedis (GH1,000,000). (8 Marks) b) Calculate the bid/ask spread for each bank and explain any two (2) factors that could account for any difference. (7 Marks) --End of Paper

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts