Question: Question 3 The North Face and Salomon set prices simultaneously for their respective hiking boots. Let pl 2 0 denote the price set by The

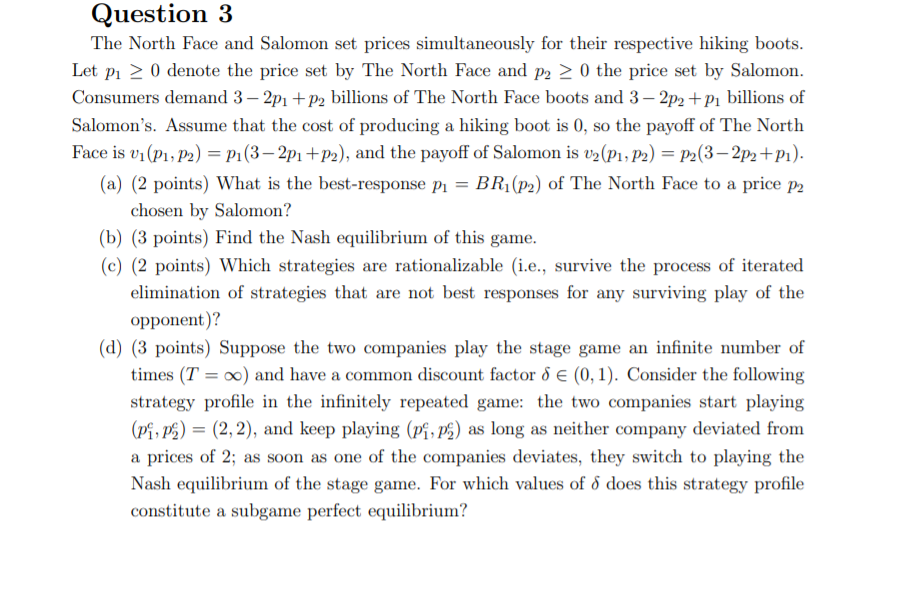

Question 3 The North Face and Salomon set prices simultaneously for their respective hiking boots. Let pl 2 0 denote the price set by The North Face and P2 2 {i the price set by Salomon. Consumers demand 3 2p1 +132 billions of The North Face boots and 3 2p; + p1 billions of Salornon's. AsSume that the cost of producing a hiking boot is 0. so the payoff of The North Face is slugging] = p1[32p1+p2), and the payoff of Salomon is vamp?) = p2(32p2 +321). (a) (2 points) What is the best-response p1 = BRILpg) of The North Face to a price p; chosen by Salomon? (b) (3 points) Find the Nash equilibriiun of this game. (e) (2 points) Which strategies are rationalizable (i.e., survive the process of iterated elimination of strategies that are not best responses for any surviving play of the Opponent)? (d) (3 points) Suppose the two companies play.r the stage game an innite number of times (T = oo) and have a common discount factor 5 E (0,1). Consider the following strategy prole in the innitely repeated game: the two companies start playing (pf, pa) = (2, 2). and keep playing (pf, pg) as long as neither company deviated from a prices of 2; as soon as one of the companies deviates! they switch to playing the Nash equilibrium of the stage game. For which values of 5 does this strategy prole constitute a subgame perfect equilibrium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts