Question: Question 3 The spot dollar - pound rate is $ 1 . 4 0 1 and the forward rate is also $ 1 . 4

Question

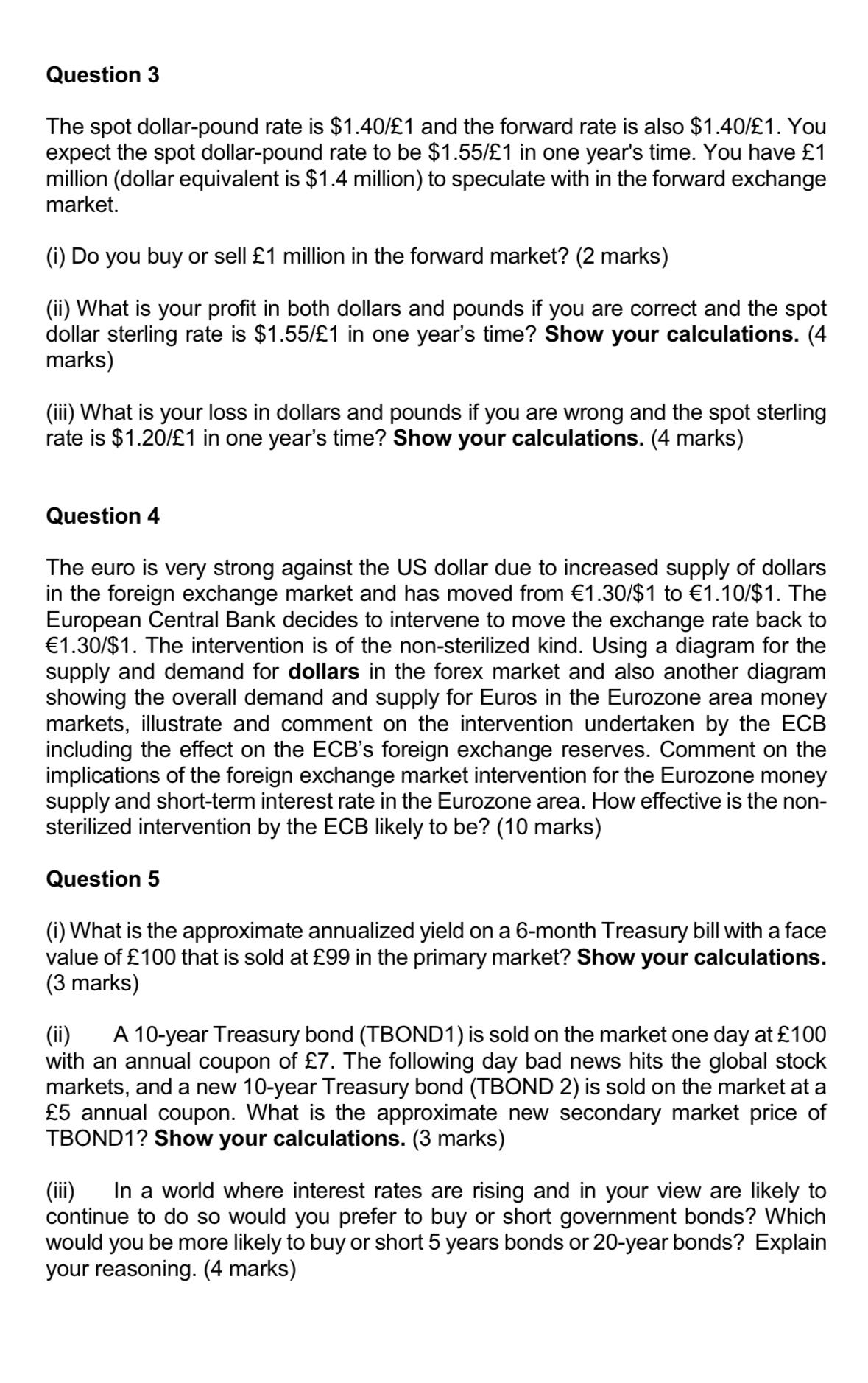

The spot dollarpound rate is $ and the forward rate is also $ You expect the spot dollarpound rate to be $ in one year's time. You have million dollar equivalent is $ million to speculate with in the forward exchange market.

i Do you buy or sell million in the forward market? marks

ii What is your profit in both dollars and pounds if you are correct and the spot dollar sterling rate is $ in one year's time? Show your calculations. marks

iii What is your loss in dollars and pounds if you are wrong and the spot sterling rate is $ in one year's time? Show your calculations. marks

Question

The euro is very strong against the US dollar due to increased supply of dollars in the foreign exchange market and has moved from to The European Central Bank decides to intervene to move the exchange rate back to The intervention is of the nonsterilized kind. Using a diagram for the supply and demand for dollars in the forex market and also another diagram showing the overall demand and supply for Euros in the Eurozone area money markets, illustrate and comment on the intervention undertaken by the ECB including the effect on the ECB's foreign exchange reserves. Comment on the implications of the foreign exchange market intervention for the Eurozone money supply and shortterm interest rate in the Eurozone area. How effective is the nonsterilized intervention by the ECB likely to be marks

Question

i What is the approximate annualized yield on a month Treasury bill with a face value of that is sold at in the primary market? Show your calculations. marks

ii A year Treasury bond TBOND is sold on the market one day at with an annual coupon of The following day bad news hits the global stock markets, and a new year Treasury bond TBOND is sold on the market at a annual coupon. What is the approximate new secondary market price of TBOND Show your calculations. marks

iii In a world where interest rates are rising and in your view are likely to continue to do so would you prefer to buy or short government bonds? Which would you be more likely to buy or short years bonds or year bonds? Explain your reasoning. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock