Question: Question 3 (This question has 3 parts (a), (b) and (c)) (a) Australia is one of a few countries that maintain a AAA credit rating.

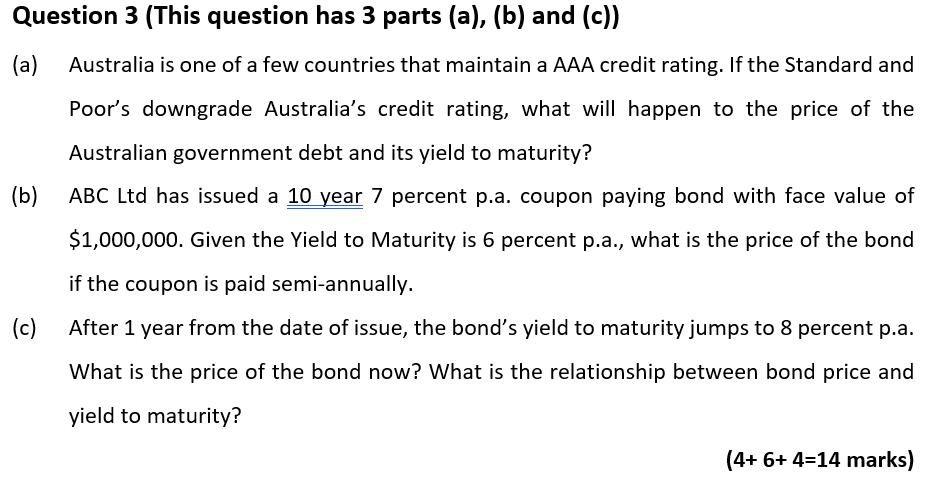

Question 3 (This question has 3 parts (a), (b) and (c)) (a) Australia is one of a few countries that maintain a AAA credit rating. If the Standard and Poor's downgrade Australia's credit rating, what will happen to the price of the Australian government debt and its yield to maturity? (b) ABC Ltd has issued a 10 year 7 percent p.a. coupon paying bond with face value of $1,000,000. Given the Yield to Maturity is 6 percent p.a., what is the price of the bond if the coupon is paid semi-annually. (c) After 1 year from the date of issue, the bond's yield to maturity jumps to 8 percent p.a. What is the price of the bond now? What is the relationship between bond price and yield to maturity? (4+ 6+4=14 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts