Question: QUESTION 3. This question has 3 subparts, please answer all subparts. 1. It's March, the current stock price for Alphabet Inc. (GOOG) is $2,041.33. Like

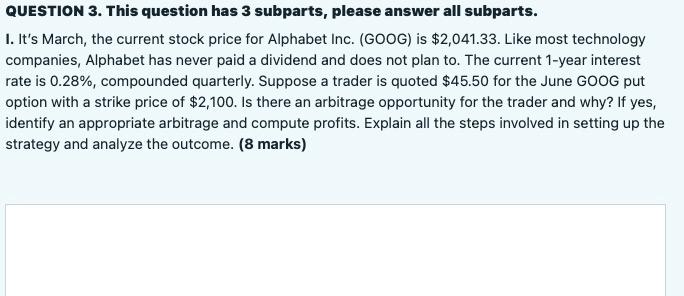

QUESTION 3. This question has 3 subparts, please answer all subparts. 1. It's March, the current stock price for Alphabet Inc. (GOOG) is $2,041.33. Like most technology companies, Alphabet has never paid a dividend and does not plan to. The current 1-year interest rate is 0.28%, compounded quarterly. Suppose a trader is quoted $45.50 for the June GOOG put option with a strike price of $2,100. Is there an arbitrage opportunity for the trader and why? If yes, identify an appropriate arbitrage and compute profits. Explain all the steps involved in setting up the strategy and analyze the outcome. (8 marks) QUESTION 3. This question has 3 subparts, please answer all subparts. 1. It's March, the current stock price for Alphabet Inc. (GOOG) is $2,041.33. Like most technology companies, Alphabet has never paid a dividend and does not plan to. The current 1-year interest rate is 0.28%, compounded quarterly. Suppose a trader is quoted $45.50 for the June GOOG put option with a strike price of $2,100. Is there an arbitrage opportunity for the trader and why? If yes, identify an appropriate arbitrage and compute profits. Explain all the steps involved in setting up the strategy and analyze the outcome. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts