Question: Question 3 This question is based on the Alpha_Beta tab of spreadsheet. Fill in the highlighted cells using appropriate formulas. Explain why the portfolio returns

Question 3

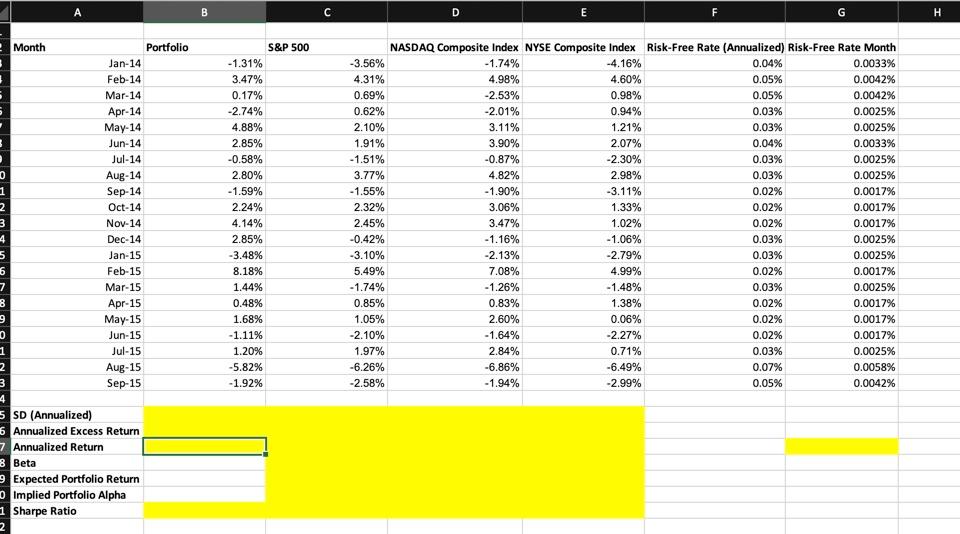

This question is based on the Alpha_Beta tab of spreadsheet.

Fill in the highlighted cells using appropriate formulas.

Explain why the portfolio returns would be different from the expected returns of the current holdings. Hint: transaction costs is part of the answer, but theres something more.

What does this mean about the way you should interpret the alpha.

A B C D E F G SD (Annualized) Annualized Excess Return Annualized Return Beta Expected Portfolio Return Implied Portfolio Alpha Sharpe Ratio A B C D E F G SD (Annualized) Annualized Excess Return Annualized Return Beta Expected Portfolio Return Implied Portfolio Alpha Sharpe Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts