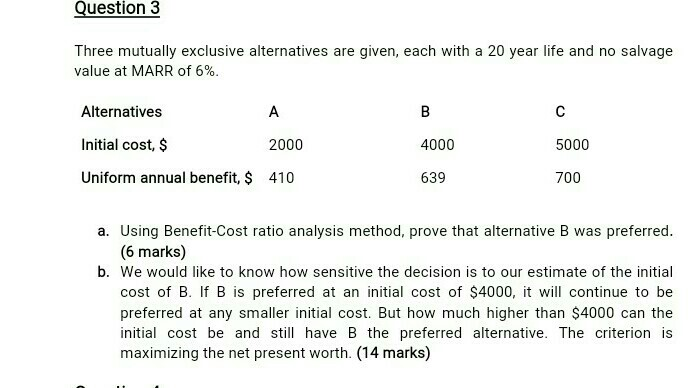

Question: Question 3 Three mutually exclusive alternatives are given, each with a 20 year life and no value at MARR of 6% salvage Alternatives A B

Question 3 Three mutually exclusive alternatives are given, each with a 20 year life and no value at MARR of 6% salvage Alternatives A B C Initial cost, $ 2000 4000 5000 Uniform annual benefit, $ 410 639 700 a. Using Benefit-Cost ratio analysis method, prove that alternative B was (6 marks) preferred. b. We would like to know how sensitive the decision is to our estimate of the initial cost of B. If B is preferred at an initial cost of $4000, it will continue to be preferred at any smaller initial cost. But how much higher than $4000 can the initial cost be and still have B the preferred alternative. The criterion is maximizing the net present worth. (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts