Question: Question 3 tmalini Trading (Pty) Ltd has been setting aside funds every month for a few years now, with a view to using the saved-up

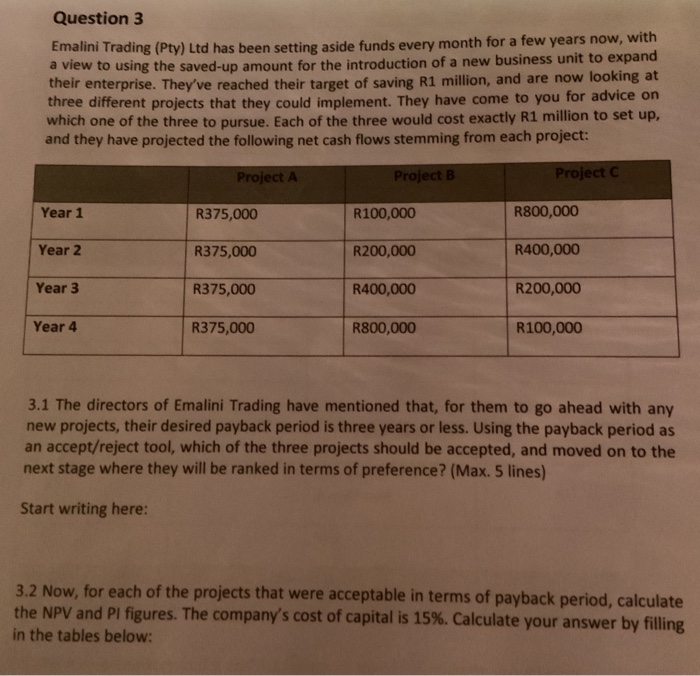

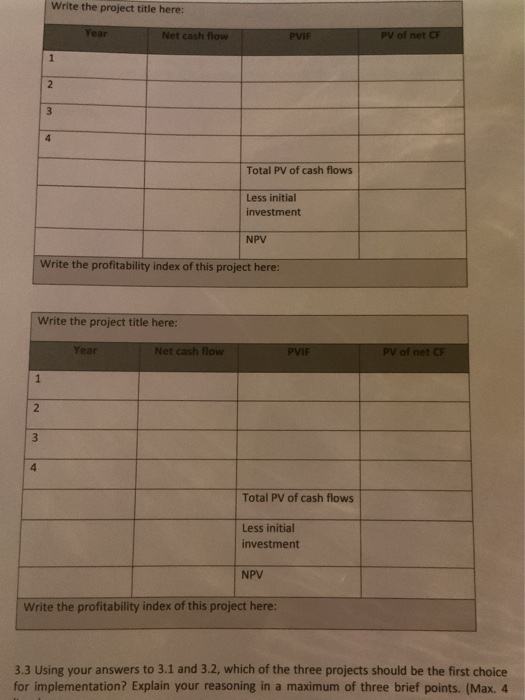

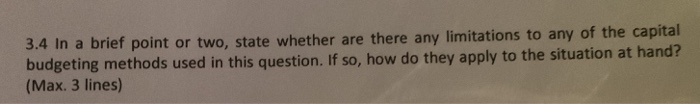

Question 3 tmalini Trading (Pty) Ltd has been setting aside funds every month for a few years now, with a view to using the saved-up amount for the introduction of a new business unit to expand their enterprise. They've reached their target of saving R1 million, and are now looking at three different projects that they could implement. They have come to you for advice on which one of the three to pursue. Each of the three would cost exactly R1 million to set up, and they have projected the following net cash flows stemming from each project: Project A Project B Project C Year 1 R375,000 R100,000 R800,000 Year 2 R375,000 R200,000 R400,000 Year 3 R375,000 R400,000 R200,000 Year 4 R375,000 R800,000 R100,000 3.1 The directors of Emalini Trading have mentioned that, for them to go ahead with any new projects, their desired payback period is three years or less. Using the payback period as an accept/reject tool, which of the three projects should be accepted, and moved on to the next stage where they will be ranked in terms of preference? (Max. 5 lines) Start writing here: 3.2 Now, for each of the projects that were acceptable in terms of payback period, calculate the NPV and PI figures. The company's cost of capital is 15%. Calculate your answer by filling in the tables below: Write the project title here: Net cash flow PV of net CF Total PV of cash flows Less initial investment NPV Write the profitability index of this project here: Write the project title here: Year Net cash flow PVIE PV of net CF Total PV of cash flows Less initial investment NPV Write the profitability index of this project here: 3.3 Using your answers to 3.1 and 3.2, which of the three projects should be the first choice for implementation? Explain your reasoning in a maximum of three brief points. (Max. 4 3.4 In a brief point or two, state whether are there any limitations to any of the capital budgeting methods used in this question. If so, how do they apply to the situation at hand? (Max. 3 lines)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts