Question: Question 3 to 5 are based on the Big Mac Index from Economist: 3. The price of big mac in China is Yuan10.5; In the

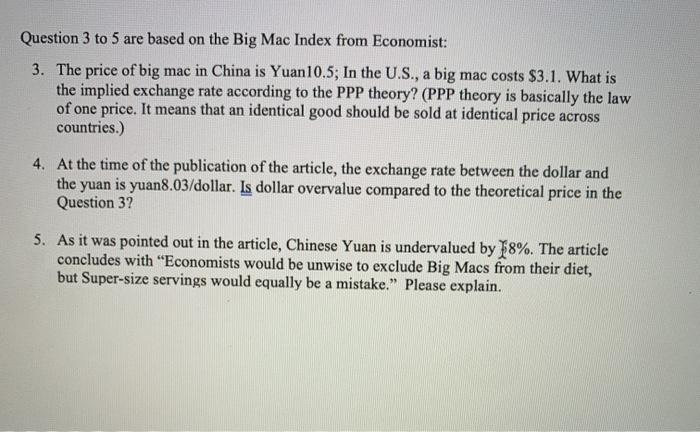

Question 3 to 5 are based on the Big Mac Index from Economist: 3. The price of big mac in China is Yuan10.5; In the U.S., a big mac costs $3.1. What is the implied exchange rate according to the PPP theory? (PPP theory is basically the law of one price. It means that an identical good should be sold at identical price across countries.) 4. At the time of the publication of the article, the exchange rate between the dollar and the yuan is yuan8.03/dollar. Is dollar overvalue compared to the theoretical price in the Question 3? 5. As it was pointed out in the article, Chinese Yuan is undervalued by 18%. The article concludes with "Economists would be unwise to exclude Big Macs from their diet, but Super-size servings would equally be a mistake." Please explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts