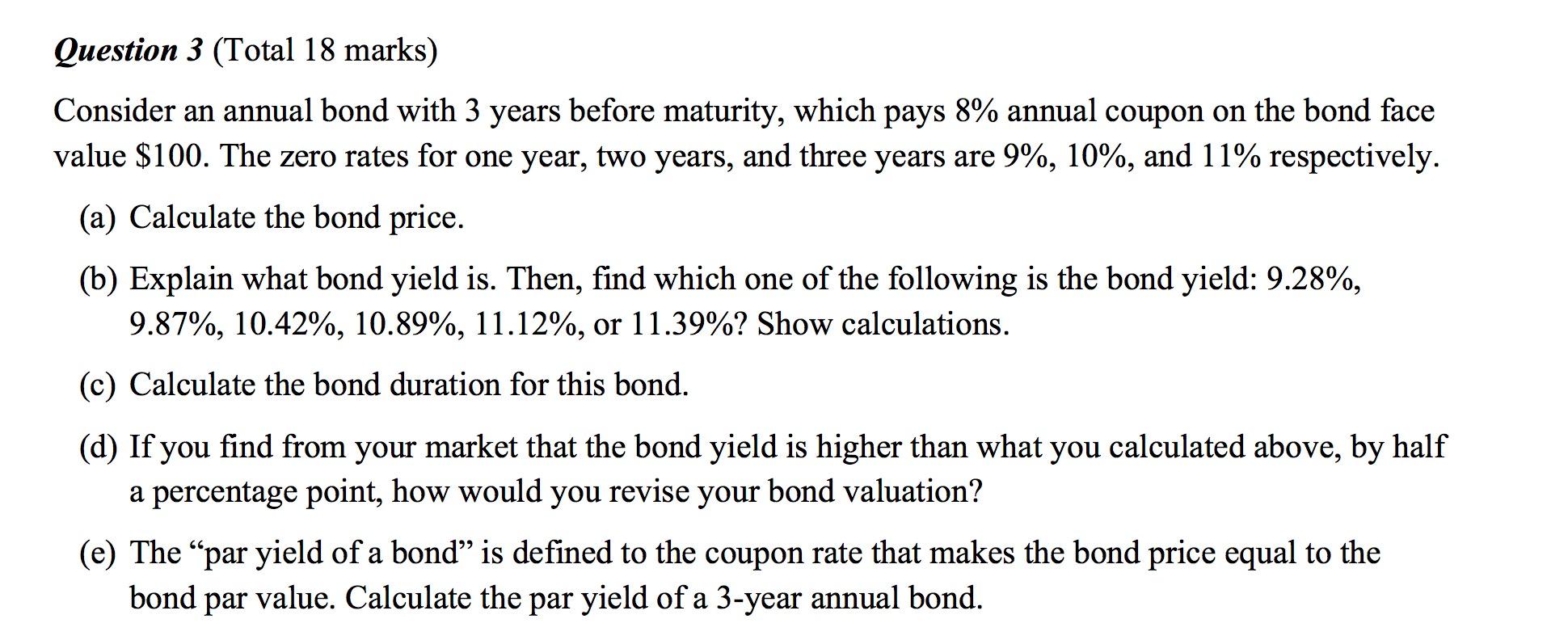

Question: Question 3 (Total 18 marks) Consider an annual bond with 3 years before maturity, which pays 8% annual coupon on the bond face value $100.

Question 3 (Total 18 marks) Consider an annual bond with 3 years before maturity, which pays 8% annual coupon on the bond face value $100. The zero rates for one year, two years, and three years are 9%, 10%, and 11% respectively. (a) Calculate the bond price. (b) Explain what bond yield is. Then, find which one of the following is the bond yield: 9.28%, 9.87%, 10.42%, 10.89%, 11.12%, or 11.39%? Show calculations. (c) Calculate the bond duration for this bond. (d) If you find from your market that the bond yield is higher than what you calculated above, by half a percentage point, how would you revise your bond valuation? (e) The "par yield of a bond is defined to the coupon rate that makes the bond price equal to the bond par value. Calculate the par yield of a 3-year annual bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts