Question: Question 3 [TOTAL MARKS 20) a. New Banks started its first day of operations with a 10 million in capital. 130 million in checkable deposits

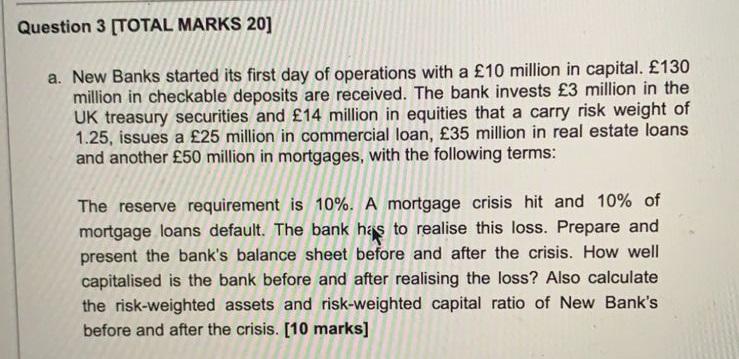

Question 3 [TOTAL MARKS 20) a. New Banks started its first day of operations with a 10 million in capital. 130 million in checkable deposits are received. The bank invests 3 million in the UK treasury securities and 14 million in equities that a carry risk weight of 1.25, issues a 25 million in commercial loan, 35 million in real estate loans and another 50 million in mortgages, with the following terms: The reserve requirement is 10%. A mortgage crisis hit and 10% of mortgage loans default. The bank has to realise this loss. Prepare and present the bank's balance sheet before and after the crisis. How well capitalised is the bank before and after realising the loss? Also calculate the risk-weighted assets and risk-weighted capital ratio of New Bank's before and after the crisis. [10 marks] Question 3 [TOTAL MARKS 20) a. New Banks started its first day of operations with a 10 million in capital. 130 million in checkable deposits are received. The bank invests 3 million in the UK treasury securities and 14 million in equities that a carry risk weight of 1.25, issues a 25 million in commercial loan, 35 million in real estate loans and another 50 million in mortgages, with the following terms: The reserve requirement is 10%. A mortgage crisis hit and 10% of mortgage loans default. The bank has to realise this loss. Prepare and present the bank's balance sheet before and after the crisis. How well capitalised is the bank before and after realising the loss? Also calculate the risk-weighted assets and risk-weighted capital ratio of New Bank's before and after the crisis. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts