Question: Question 3 Use an Excel spreadsheet to calculate the appropriate price and yield to maturity for the three bonds listed below: a. Bond with coupon

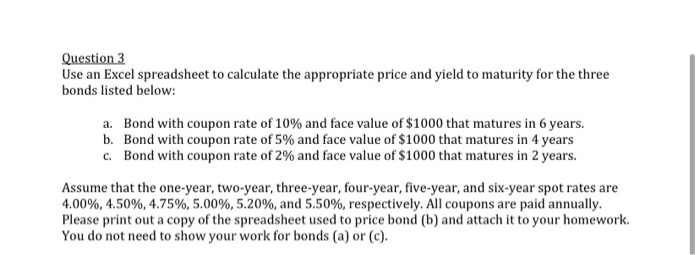

Question 3 Use an Excel spreadsheet to calculate the appropriate price and yield to maturity for the three bonds listed below: a. Bond with coupon rate of 10% and face value of $1000 that matures in 6 years. b. Bond with coupon rate of 5% and face value of $1000 that matures in 4 years c. Bond with coupon rate of 2% and face value of $1000 that matures in 2 years Assume that the one-year, two-year, three-year, four-year, five-year, and six-year spot rates are 4.00%, 4.50%, 4.75%, 5.00%, 5.20%, and 5.50%, respectively. All coupons are paid annually. Please print out a copy of the spreadsheet used to price bond (b) and attach it to your homework. You do not need to show your work for bonds (a) or (C)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts