Question: QUESTION 3 Use the information provided below to prepare the Cash Flow Statement of Harmony Limited for the year ended 31 December 2020. (20 Marks)

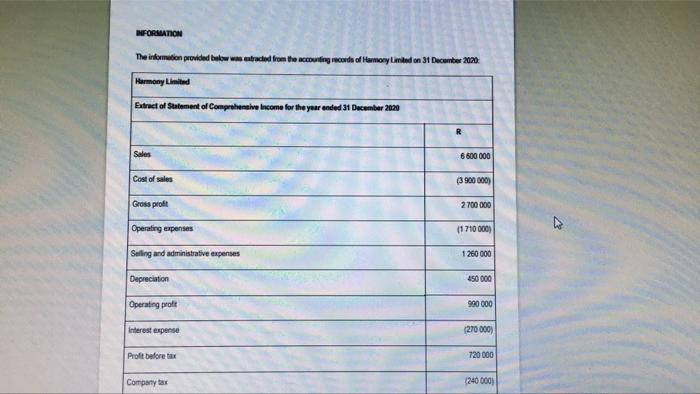

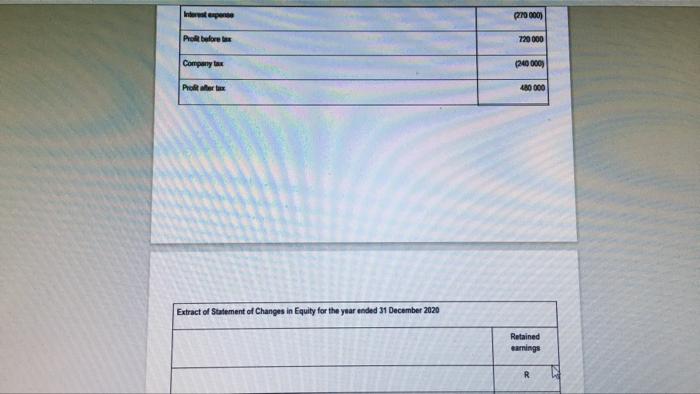

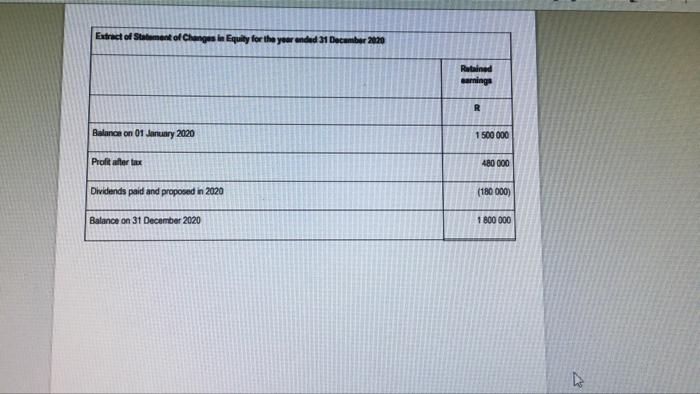

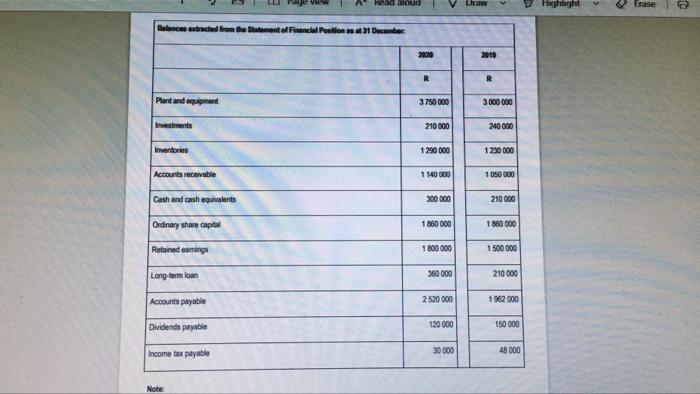

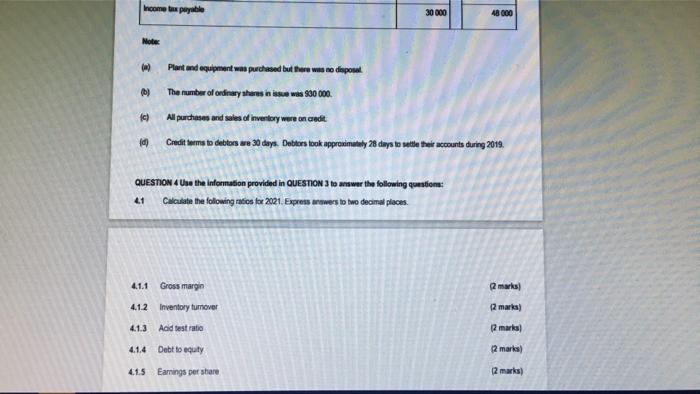

QUESTION 3 Use the information provided below to prepare the Cash Flow Statement of Harmony Limited for the year ended 31 December 2020. (20 Marks) INFORMATION The information provided bebww traced from the accounting anda olunany Limited December 2020 Harmony Limited Extract of Statement of Comprehensive Income for the year ended 31 December 2010 R Sales 6 600 000 Cost of sales 3900 000) Gross profit 2700 000 V Operating expenses (1710000) Suling and administrative expenses 1 260 000 Depreciation 450 000 Operating prote 990 000 Interest expense (270 000) Profit beforex 720 000 Company tax 1240 000) Wersport 0270000) Potwores 720 000 Company 240000) Powers 180 000 Extract of Statement of Changes in Equity for the year ended 31 December 2020 Retained earnings R Extract of Statement of Changes in Equity for the year anded 31 December 2020 Retained warning R Balance on 01 January 2020 1 500 000 Prolatertex 480 000 Dividends paid and proposed in 2020 (180 000) Balance on 31 December 2020 1 800 000 Head aloud Draw Frase Balance bed from the Stato Flancial Polies 1 December 2020 2018 R R Plant and equipment 3 750 000 3 000 000 Investments 210 000 240 000 Inventories 1 290 000 1 230 000 Accounts receivable 1 140 000 1 050 000 Cash and cash equivalents 300 000 210 000 Ordinary share capital 1860 000 1 860 000 Retained emings 1 800 000 1 500 000 Long-term loan 360 000 210 000 Accounts payable 2 520 000 1962 000 Dividends payable 120 000 150 000 Income tax payable 30 000 48000 Note: Income tax payable 30 000 48000 Notes ) Plant and equipment was purchased but there was no depok The number of ordinay shares we w 530 000 All purchase and sales o inventory were con credit Credit forms to debton was 30 days. Deblers took approximately 28 days to sette hele ecounts during 2019. c) QUESTION 4 Use the information provided in QUESTION 3 to answer the following question: Calculate the following ratios for 2021. Expresswers to two decimal places 41 4.1.1 Gross margin 2 marks) 4.1.2 Inventory tumover (2 marks) 413 Aad test ratio 2 marks 4.1.4 Debt touty (2 marks) 41.5 Eamings per share (2 marks) 4.1.1 Gross margin 2 marks) 4.1.2 Inventory turnover (2 marks) 4.1.3 Acid test ratio (2 marks) 4.1.4 Debt to equity (2 marks) 41.5 Earnings per share (2 marks) 4.2 (4 marks) 43 (3 marks) Are the collections from credit sales satisfactory? Motivate your answer by using the relevant ratio Would the shareholders of Harmony Limited be satisfied with the return on their investments? Motivate your answer with the use of a relevant ratio. Suggest THREE (3) ways in which Harmony Limited can improve its gross margin ratio, without increasing the selling price of the inventories 4.4 (3 marks) QUESTION 3 Use the information provided below to prepare the Cash Flow Statement of Harmony Limited for the year ended 31 December 2020. (20 Marks) INFORMATION The information provided bebww traced from the accounting anda olunany Limited December 2020 Harmony Limited Extract of Statement of Comprehensive Income for the year ended 31 December 2010 R Sales 6 600 000 Cost of sales 3900 000) Gross profit 2700 000 V Operating expenses (1710000) Suling and administrative expenses 1 260 000 Depreciation 450 000 Operating prote 990 000 Interest expense (270 000) Profit beforex 720 000 Company tax 1240 000) Wersport 0270000) Potwores 720 000 Company 240000) Powers 180 000 Extract of Statement of Changes in Equity for the year ended 31 December 2020 Retained earnings R Extract of Statement of Changes in Equity for the year anded 31 December 2020 Retained warning R Balance on 01 January 2020 1 500 000 Prolatertex 480 000 Dividends paid and proposed in 2020 (180 000) Balance on 31 December 2020 1 800 000 Head aloud Draw Frase Balance bed from the Stato Flancial Polies 1 December 2020 2018 R R Plant and equipment 3 750 000 3 000 000 Investments 210 000 240 000 Inventories 1 290 000 1 230 000 Accounts receivable 1 140 000 1 050 000 Cash and cash equivalents 300 000 210 000 Ordinary share capital 1860 000 1 860 000 Retained emings 1 800 000 1 500 000 Long-term loan 360 000 210 000 Accounts payable 2 520 000 1962 000 Dividends payable 120 000 150 000 Income tax payable 30 000 48000 Note: Income tax payable 30 000 48000 Notes ) Plant and equipment was purchased but there was no depok The number of ordinay shares we w 530 000 All purchase and sales o inventory were con credit Credit forms to debton was 30 days. Deblers took approximately 28 days to sette hele ecounts during 2019. c) QUESTION 4 Use the information provided in QUESTION 3 to answer the following question: Calculate the following ratios for 2021. Expresswers to two decimal places 41 4.1.1 Gross margin 2 marks) 4.1.2 Inventory tumover (2 marks) 413 Aad test ratio 2 marks 4.1.4 Debt touty (2 marks) 41.5 Eamings per share (2 marks) 4.1.1 Gross margin 2 marks) 4.1.2 Inventory turnover (2 marks) 4.1.3 Acid test ratio (2 marks) 4.1.4 Debt to equity (2 marks) 41.5 Earnings per share (2 marks) 4.2 (4 marks) 43 (3 marks) Are the collections from credit sales satisfactory? Motivate your answer by using the relevant ratio Would the shareholders of Harmony Limited be satisfied with the return on their investments? Motivate your answer with the use of a relevant ratio. Suggest THREE (3) ways in which Harmony Limited can improve its gross margin ratio, without increasing the selling price of the inventories 4.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts