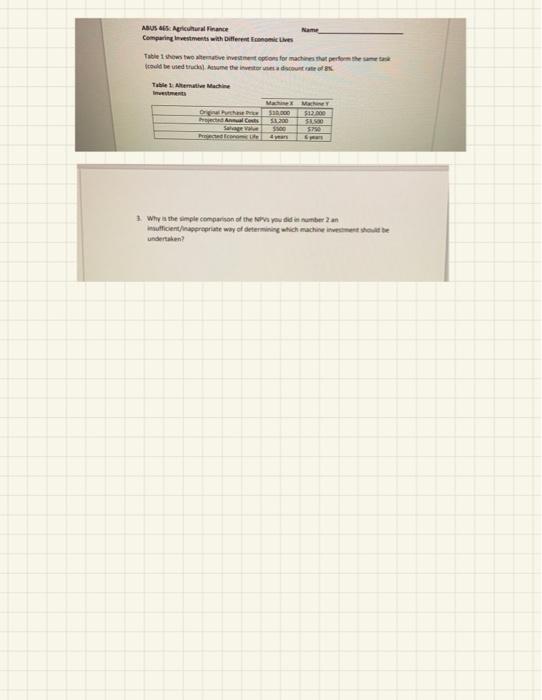

Question: question #3 using question #2 information to answer question #3 ASUS Agricultural Finance Comparing rements with differences Table 1 how wovenester for machines the theme

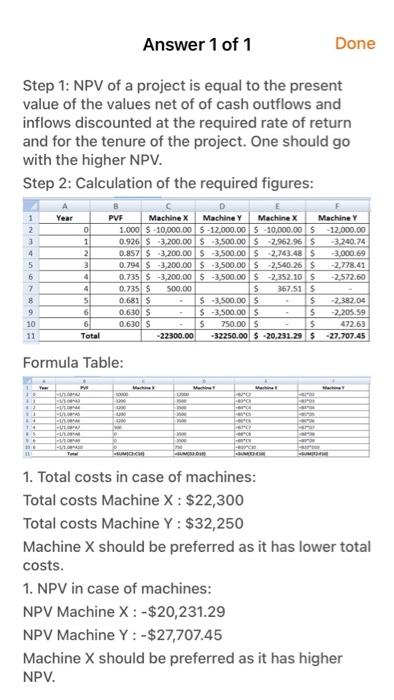

ASUS Agricultural Finance Comparing rements with differences Table 1 how wovenester for machines the theme cadde vierde the inte Table 1 Alert Machine MX MY D000 $12 The Anna Costs SIC 3.300 57 3 Why is the simple comparison of the you did umbean mufficient propriate way of determining which machine the undertaken? Answer 1 of 1 Done Step 1: NPV of a project is equal to the present value of the values net of of cash outflows and inflows discounted at the required rate of return and for the tenure of the project. One should go with the higher NPV. Step 2: Calculation of the required figures: Year 1 2 3 4 0 1 2 3 4 5 6 PVF Machine X Machine Y Machine X Machine Y 1.000 $10,000.00 5 -12,000.00 5 -10,000.00 S - 12.000.00 0.926 S 3,200.00 S 3,500.00 $ 2,962.965 3.240.74 0.857 $3,200.00 $ 3,500.00 $ 2,743.48 $ 3,000.69 0.794 $3,200.00 $3,500.00 S-2,540.26 $ -2.778.41 0.735 $ -3,200.00 $ -3,500.00 $ -2,352.10 S -2.572.60 0.735 S 500.00 S 367-51 15 0.681 S $ 3.500.00 S $ 2.382.04 0.6301 S $ -3,500.00 $ -2.205.59 0.630 $ $ 750.00 $ $ 472.63 -22300.00 -32250.00 $ -20.231.29 $ -27,707.45 7 4 8 9 5 6 6 Total 10 11 Formula Table: 1. 10 re . T TE 1. Total costs in case of machines: Total costs Machine X: $22,300 Total costs Machine Y: $32,250 Machine X should be preferred as it has lower total costs. 1. NPV in case of machines: NPV Machine X:-$20,231.29 NPV Machine Y:-$27,707.45 Machine X should be preferred as it has higher NPV. ASUS Agricultural Finance Comparing rements with differences Table 1 how wovenester for machines the theme cadde vierde the inte Table 1 Alert Machine MX MY D000 $12 The Anna Costs SIC 3.300 57 3 Why is the simple comparison of the you did umbean mufficient propriate way of determining which machine the undertaken? Answer 1 of 1 Done Step 1: NPV of a project is equal to the present value of the values net of of cash outflows and inflows discounted at the required rate of return and for the tenure of the project. One should go with the higher NPV. Step 2: Calculation of the required figures: Year 1 2 3 4 0 1 2 3 4 5 6 PVF Machine X Machine Y Machine X Machine Y 1.000 $10,000.00 5 -12,000.00 5 -10,000.00 S - 12.000.00 0.926 S 3,200.00 S 3,500.00 $ 2,962.965 3.240.74 0.857 $3,200.00 $ 3,500.00 $ 2,743.48 $ 3,000.69 0.794 $3,200.00 $3,500.00 S-2,540.26 $ -2.778.41 0.735 $ -3,200.00 $ -3,500.00 $ -2,352.10 S -2.572.60 0.735 S 500.00 S 367-51 15 0.681 S $ 3.500.00 S $ 2.382.04 0.6301 S $ -3,500.00 $ -2.205.59 0.630 $ $ 750.00 $ $ 472.63 -22300.00 -32250.00 $ -20.231.29 $ -27,707.45 7 4 8 9 5 6 6 Total 10 11 Formula Table: 1. 10 re . T TE 1. Total costs in case of machines: Total costs Machine X: $22,300 Total costs Machine Y: $32,250 Machine X should be preferred as it has lower total costs. 1. NPV in case of machines: NPV Machine X:-$20,231.29 NPV Machine Y:-$27,707.45 Machine X should be preferred as it has higher NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts