Question: Question 3: Variance Analysis (20 marks in total) A Chill Menu Company produces cases of frozen food. During April, the company produced 1,450 cases of

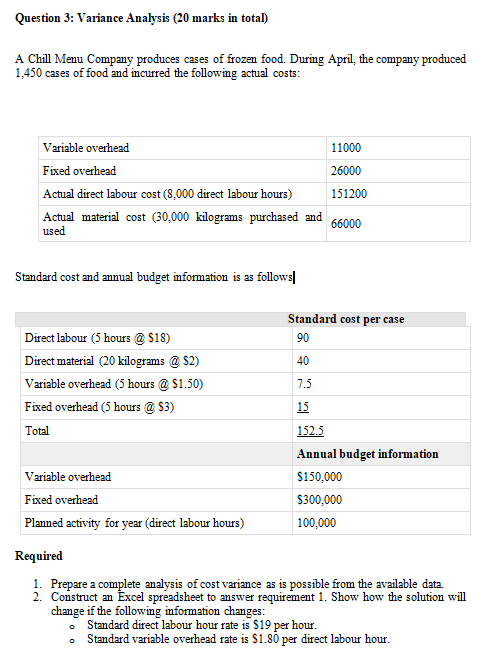

Question 3: Variance Analysis (20 marks in total)

Question 3: Variance Analysis (20 marks in total)

A Chill Menu Company produces cases of frozen food. During April, the company produced 1,450 cases of food and incurred the following actual costs:

| Variable overhead | 11000 |

| Fixed overhead | 26000 |

| Actual direct labour cost (8,000 direct labour hours) | 151200 |

| Actual material cost (30,000 kilograms purchased and used | 66000 |

Standard cost and annual budget information is as follows:

| Standard cost per case | |

| Direct labour (5 hours @ $18) | 90 |

| Direct material (20 kilograms @ $2) | 40 |

| Variable overhead (5 hours @ $1.50) | 7.5 |

| Fixed overhead (5 hours @ $3) | 15 |

| Total | 152.5 |

| Annual budget information | |

| Variable overhead | $150,000 |

| Fixed overhead | $300,000 |

| Planned activity for year (direct labour hours) | 100,000 |

Required

- Prepare a complete analysis of cost variance as is possible from the available data.

- Construct an Excel spreadsheet to answer requirement 1. Show how the solution will change if the following information changes:

- Standard direct labour hour rate is $19 per hour.

- Standard variable overhead rate is $1.80 per direct labour hour.

Question 3: Variance Analysis (20 marks in total) A Chill Menu Company produces cases of frozen food. During April, the company produced 1,450 cases of food and mcurred the followimg actual costs Variable overhead Fixed overhead Actual direct labour cost (8,000 direct labour hours) Actual material cost (30,000 kilograms purchased and 11000 26000 151200 66000 used Standard cost and annual budget information is as follows Standard cost per case Direct labour (5 hours S18) Direct material (20 kilograms @ S2) Variable overhead (5 hours @S1.50) Fixed overhead (5 hours @ S3) Total 90 40 15 152.5 Annual budget information S150,000 S300,000 100,000 Variable overhead Fixed overhead Planned activity for year (direct labour hours) Required 1. Prepare a 2. Construct an analysis of cost variance as is possible from the available data. spreadsheet to answer requirement 1. Show how the solution will change if the following mformation changes Standard direct labour hour rate is $19 per hour Standard variable overhead rate is $1.80 per direct labour hour. o o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts