Question: QUESTION 3 We consider a 4-period binomial tree model for a call option. Suppose the risk-free interest rate is 4%, the up-factor u = 1.125,

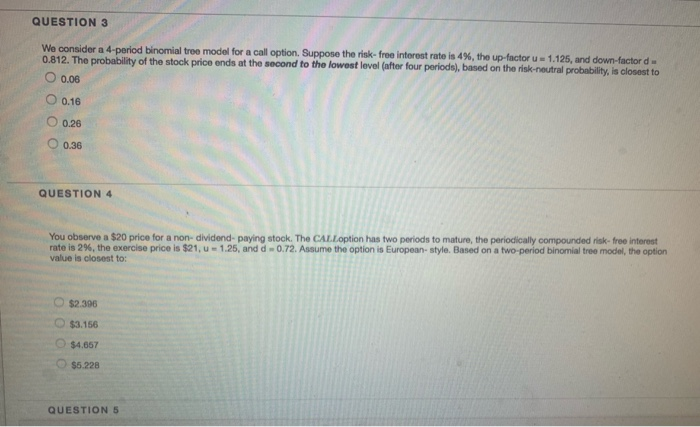

QUESTION 3 We consider a 4-period binomial tree model for a call option. Suppose the risk-free interest rate is 4%, the up-factor u = 1.125, and down-factor de 0.812. The probability of the stock price ends at the second to the lowest level (after four periods), based on the risk-neutral probability is closest to O 0.06 O 0.18 O 0.26 0.36 QUESTION 4 You observe a $20 price for a non-dividend paying stock. The CALL option has two periods to mature, the periodically compounded risk-free interest rate is 2%, the exercise price is $21, u = 1.25, and d 0.72. Assume the option is European style. Based on a two-period binomial tree model, the option value is closest to: $2,306 $3.156 $4.657 $5.228 QUESTION 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts