Question: QUESTION 3: Weighted Average Cost of Capital (10 marks) FinCo Ltd has a beta of .85 . The market risk premium is 8%, and Treasury

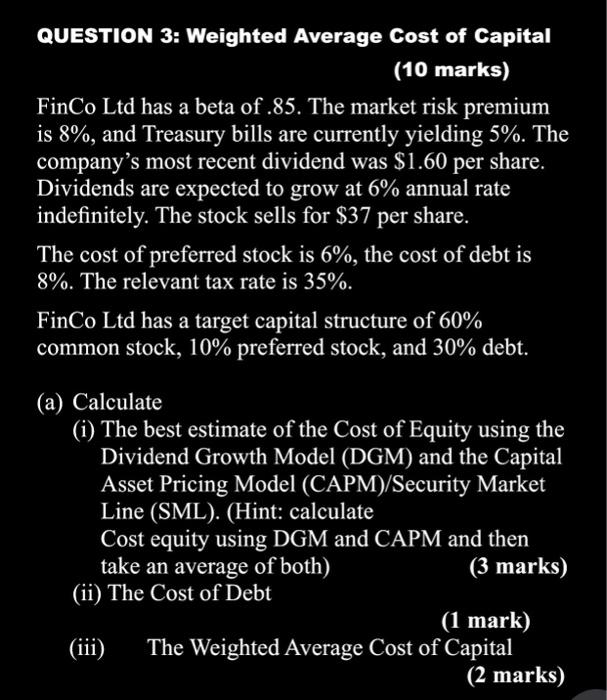

QUESTION 3: Weighted Average Cost of Capital (10 marks) FinCo Ltd has a beta of .85 . The market risk premium is 8%, and Treasury bills are currently yielding 5%. The company's most recent dividend was $1.60 per share. Dividends are expected to grow at 6% annual rate indefinitely. The stock sells for $37 per share. The cost of preferred stock is 6%, the cost of debt is 8%. The relevant tax rate is 35%. FinCo Ltd has a target capital structure of 60% common stock, 10% preferred stock, and 30% debt. (a) Calculate (i) The best estimate of the Cost of Equity using the Dividend Growth Model (DGM) and the Capital Asset Pricing Model (CAPM)/Security Market Line (SML). (Hint: calculate Cost equity using DGM and CAPM and then take an average of both) (3 marks) (ii) The Cost of Debt (1 mark) (iii) The Weighted Average Cost of Capital (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts