Question: QUESTION 3 What is the economic intuition behind the difference between the perpetual bond formula and the constant gordon growth model,? Stock and bond investors

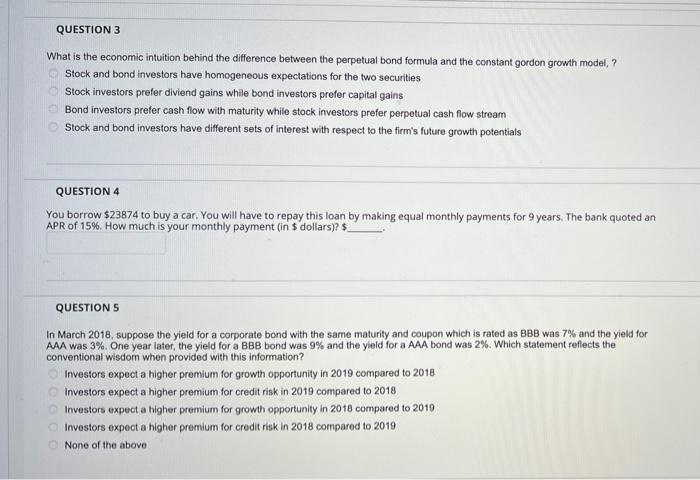

QUESTION 3 What is the economic intuition behind the difference between the perpetual bond formula and the constant gordon growth model,? Stock and bond investors have homogeneous expectations for the two securities Stock investors prefer diviend gains while bond investors prefer capital gains Bond investors prefer cash flow with maturity while stock investors prefer perpetual cash flow stream Stock and bond investors have different sets of interest with respect to the firm's future growth potentials QUESTION 4 You borrow $23874 to buy a car. You will have to repay this loan by making equal monthly payments for 9 years. The bank quoted an APR of 15%. How much is your monthly payment (in $ dollars)? $. QUESTIONS In March 2018, suppose the yield for a corporate bond with the same maturity and coupon which is rated as BBB was 7% and the yield for AAA was 3%. One year later, the yield for a BBB bond was 9% and the yield for a AAA bond was 2%. Which statement reflects the conventional wisdom when provided with this information? Investors expect a higher premium for growth opportunity in 2019 compared to 2018 Investors expect a higher premium for credit risk in 2019 compared to 2018 Investors expect a higher premium for growth opportunity in 2018 compared to 2019 Investors expect a higher premium for credit risk in 2018 compared to 2019 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts