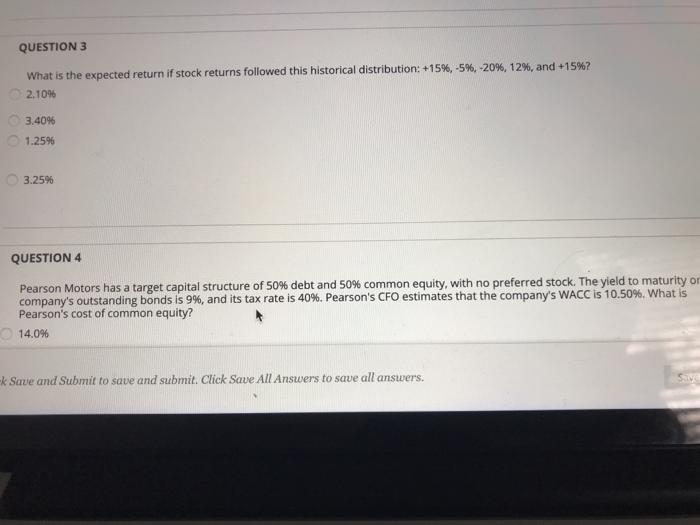

Question: QUESTION 3 What is the expected return if stock returns followed this historical distribution: +15%, -5%, -20%, 12%, and +15%? 2.10% 3,40% 1.2596 3.25% QUESTION

QUESTION 3 What is the expected return if stock returns followed this historical distribution: +15%, -5%, -20%, 12%, and +15%? 2.10% 3,40% 1.2596 3.25% QUESTION 4 Pearson Motors has a target capital structure of 50% debt and 50% common equity, with no preferred stock. The yield to maturity or company's outstanding bonds is 9%, and its tax rate is 40%. Pearson's CFO estimates that the company's WACC IS 10.50%. What is Pearson's cost of common equity? 14.0% -k Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock