Question: Question 3 with a full steps please Whitewater has a beta of 0.9. The risk-free rate is equal to 3% and the market risk premium

Question 3 with a full steps please

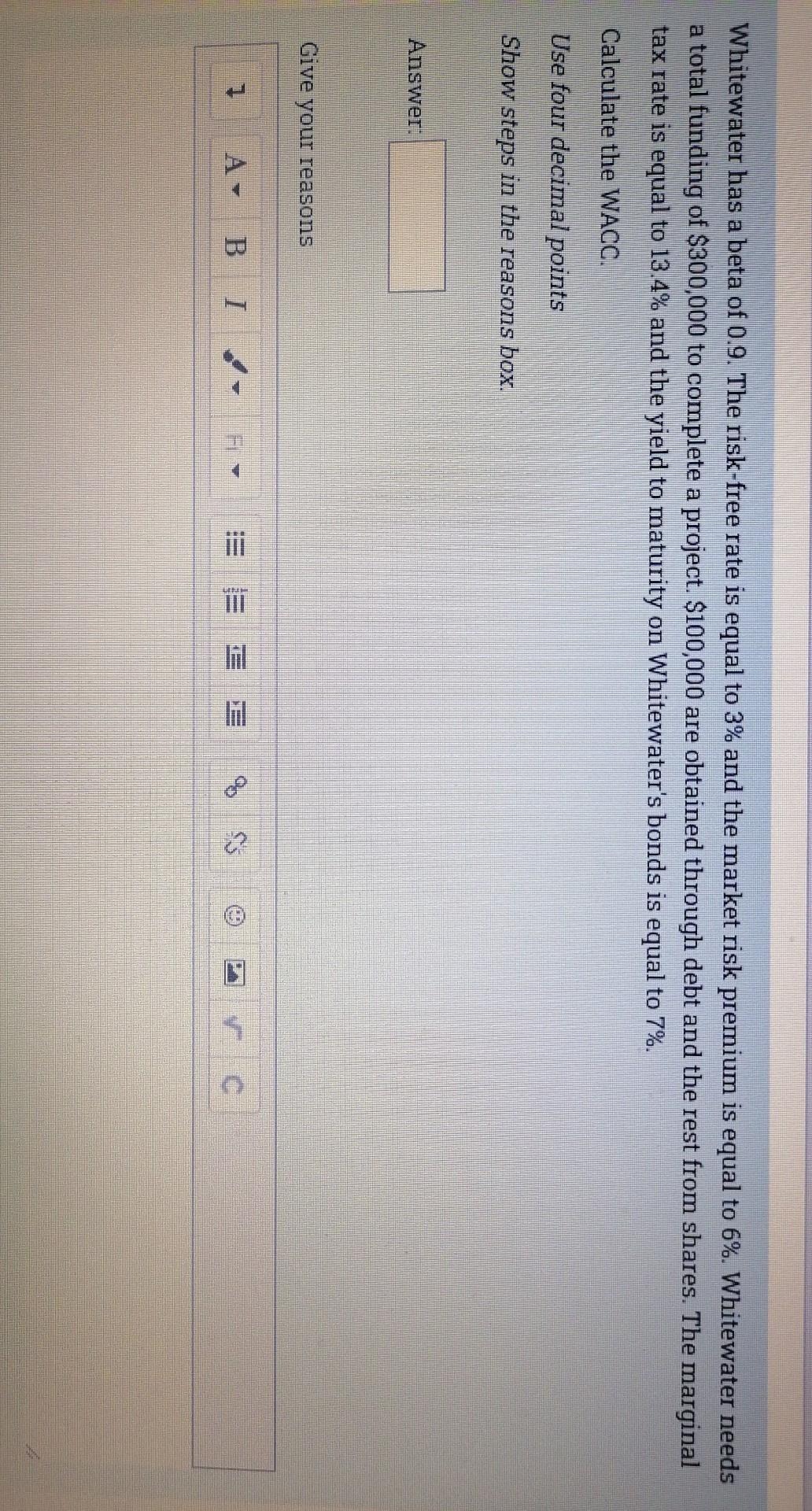

Whitewater has a beta of 0.9. The risk-free rate is equal to 3% and the market risk premium is equal to 6%. Whitewater needs a total funding of $300,000 to complete a project. $100,000 are obtained through debt and the rest from shares. The marginal tax rate is equal to 13.4% and the yield to maturity on Whitewater's bonds is equal to 7%. Calculate the WACC. Use four decimal points Show steps in the reasons box. Answer: Give your reasons 1 A- B I V ii = E E VIC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts