Question: Question 3 : ( Word limit 2000) Companies often issues bonds to raise fund for their expansion. The HBIS Group of China, one of the

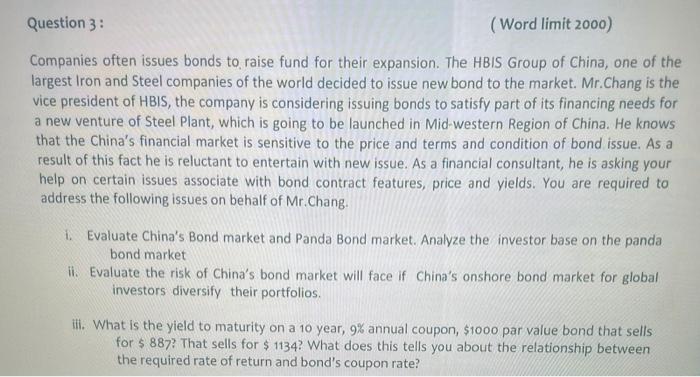

Question 3 : ( Word limit 2000) Companies often issues bonds to raise fund for their expansion. The HBIS Group of China, one of the largest Iron and Steel companies of the world decided to issue new bond to the market. Mr.Chang is the vice president of HBIS, the company is considering issuing bonds to satisfy part of its financing needs for a new venture of Steel Plant, which is going to be launched in Mid-western Region of China. He knows that the China's financial market is sensitive to the price and terms and condition of bond issue. As a result of this fact he is reluctant to entertain with new issue. As a financial consultant, he is asking your help on certain issues associate with bond contract features, price and yields. You are required to address the following issues on behalf of Mr. Chang. 1. Evaluate China's Bond market and Panda Bond market. Analyze the investor base on the panda bond market ii. Evaluate the risk of China's bond market will face if China's onshore bond market for global investors diversify their portfolios. ill. What is the yield to maturity on a 10 year, 9% annual coupon, $1000 par value bond that sells for $ 887? That sells for $ 1134? What does this tells you about the relationship between the required rate of return and bond's coupon rate? Question 3 : ( Word limit 2000) Companies often issues bonds to raise fund for their expansion. The HBIS Group of China, one of the largest Iron and Steel companies of the world decided to issue new bond to the market. Mr.Chang is the vice president of HBIS, the company is considering issuing bonds to satisfy part of its financing needs for a new venture of Steel Plant, which is going to be launched in Mid-western Region of China. He knows that the China's financial market is sensitive to the price and terms and condition of bond issue. As a result of this fact he is reluctant to entertain with new issue. As a financial consultant, he is asking your help on certain issues associate with bond contract features, price and yields. You are required to address the following issues on behalf of Mr. Chang. 1. Evaluate China's Bond market and Panda Bond market. Analyze the investor base on the panda bond market ii. Evaluate the risk of China's bond market will face if China's onshore bond market for global investors diversify their portfolios. ill. What is the yield to maturity on a 10 year, 9% annual coupon, $1000 par value bond that sells for $ 887? That sells for $ 1134? What does this tells you about the relationship between the required rate of return and bond's coupon rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts