Question: Question 3 You also have a second potential project, with a different real option. The project will have an initial cost of (

Question

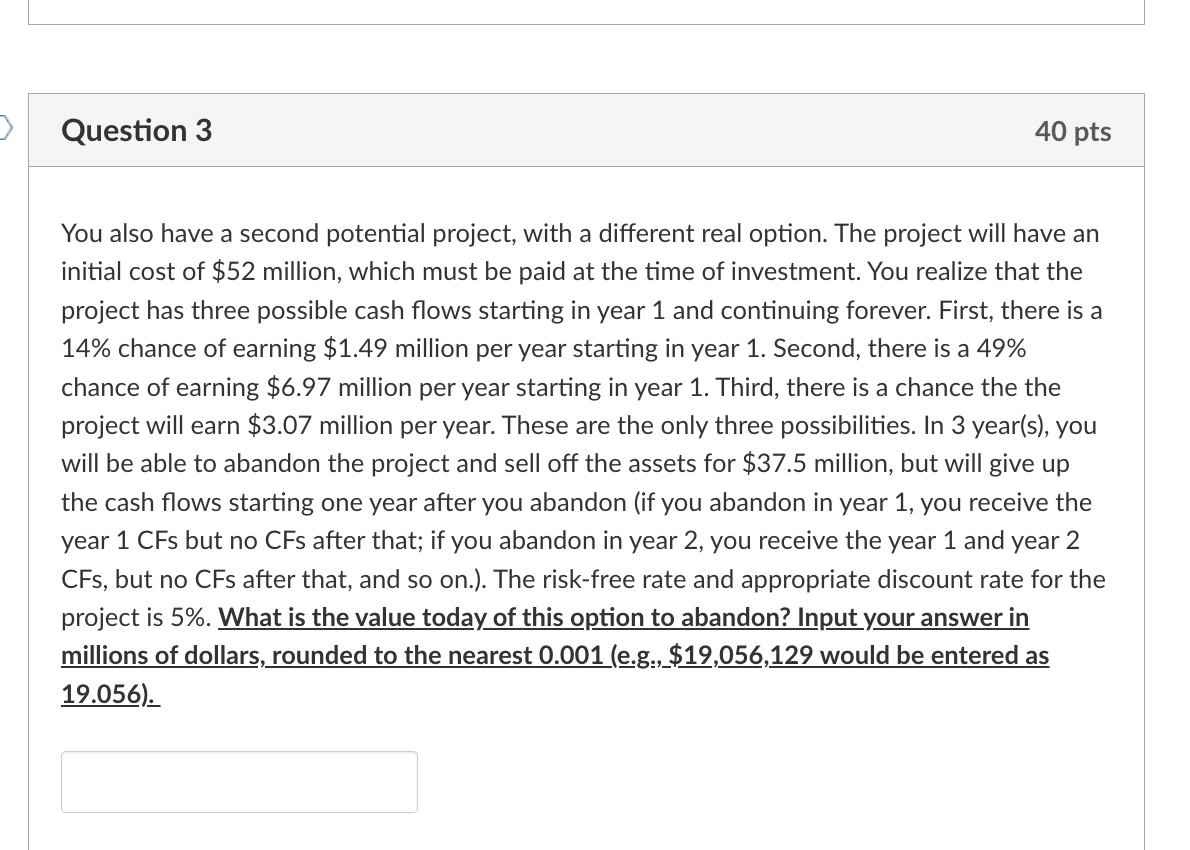

You also have a second potential project, with a different real option. The project will have an initial cost of $ million, which must be paid at the time of investment. You realize that the project has three possible cash flows starting in year and continuing forever. First, there is a chance of earning $ million per year starting in year Second, there is a chance of earning $ million per year starting in year Third, there is a chance the the project will earn $ million per year. These are the only three possibilities. In years you will be able to abandon the project and sell off the assets for $ million, but will give up the cash flows starting one year after you abandon if you abandon in year you receive the year CFs but no CFs after that; if you abandon in year you receive the year and year CFs but no CFs after that, and so on The riskfree rate and appropriate discount rate for the project is What is the value today of this option to abandon? Input your answer in millions of dollars, rounded to the nearest eg:$ would be entered as

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock