Question: QUESTION 3 You are considering two independent projects, projects A and project B. The initial cash Flow outlay associated with project A is $50,000, and

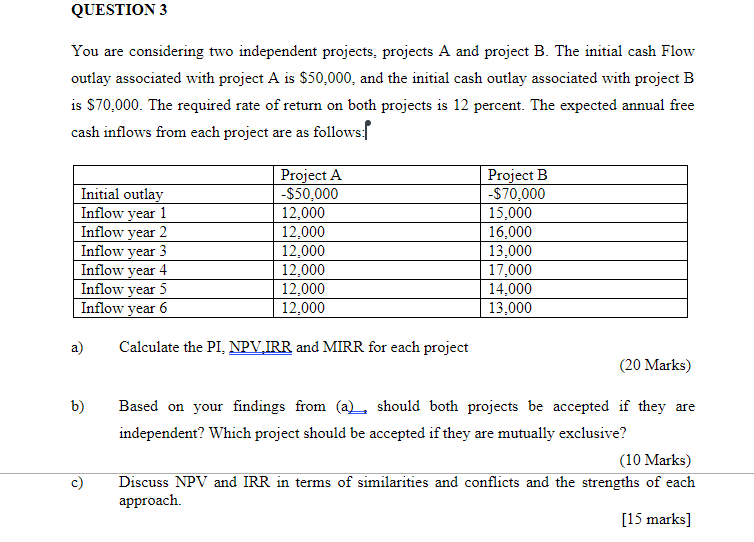

QUESTION 3 You are considering two independent projects, projects A and project B. The initial cash Flow outlay associated with project A is $50,000, and the initial cash outlay associated with project B is $70,000. The required rate of return on both projects is 12 percent. The expected annual free cash inflows from each project are as follows: Project A Project B -$70,000 Initial outlay -$50,000 Inflow year 1 12,000 15,000 Inflow year 2 12,000 16,000 Inflow year 3 12,000 13,000 Inflow year 4 12,000 17,000 Inflow year 5 12,000 14,000 Inflow year 6 12,000 13,000 a) Calculate the PI, NPV IRR and MIRR for each project (20 Marks) b) Based on your findings from (a) should both projects be accepted if they are independent? Which project should be accepted if they are mutually exclusive? (10 Marks) c) Discuss NPV and IRR in terms of similarities and conflicts and the strengths of each approach. [15 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts