Question: Question 3. You are working for an aggressive private equity fund. You want to evaluate a possible acquisition of CovidVac plc, which specialises in producing

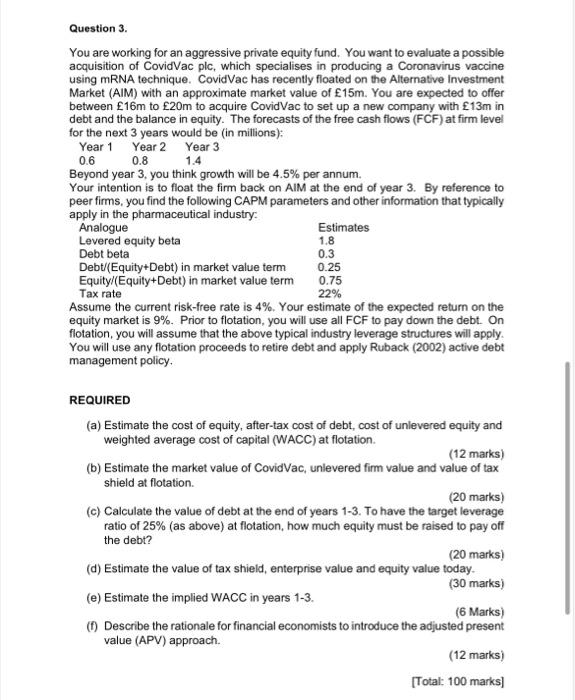

Question 3. You are working for an aggressive private equity fund. You want to evaluate a possible acquisition of CovidVac plc, which specialises in producing a Coronavirus vaccine using mRNA technique. CovidVac has recently floated on the Alternative Investment Market (AlM) with an approximate market value of 15m. You are expected to offer between 16m to 20m to acquire CovidVac to set up a new company with 13m in debt and the balance in equity. The forecasts of the free cash flows (FCF) at firm level for the next 3 years would be (in millions): Year10.6Year20.8Year31.4 Beyond year 3 , you think growth will be 4.5% per annum. Your intention is to float the firm back on AlM at the end of year 3 . By reference to peer firms, you find the following CAPM parameters and other information that typically apply in the pharmaceutical industry: Assume the current risk-free rate is 4%. Your estimate of the expected return on the equity market is 9%. Prior to flotation, you will use all FCF to pay down the debt. On flotation, you will assume that the above typical industry leverage structures will apply. You will use any flotation proceeds to retire debt and apply Ruback (2002) active debt management policy. REQUIRED (a) Estimate the cost of equity, after-tax cost of debt, cost of unlevered equity and weighted average cost of capital (WACC) at flotation. (12 marks) (b) Estimate the market value of CovidVac, unlevered firm value and value of tax shield at flotation. (20 marks) (c) Calculate the value of debt at the end of years 1-3. To have the target leverage ratio of 25% (as above) at flotation, how much equity must be raised to pay off the debt? (20 marks) (d) Estimate the value of tax shield, enterprise value and equity value today. ( 30 marks) (e) Estimate the implied WACC in years 13. (6 Marks) (f) Describe the rationale for financial economists to introduce the adjusted present value (APV) approach. (12 marks) [Total: 100 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts