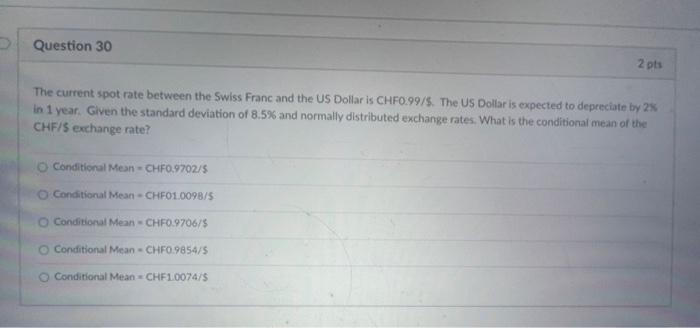

Question: Question 30 2 pts The current spot rate between the Swiss Franc and the US Dollar is CHF0.99/5. The US Dollar is expected to depreciate

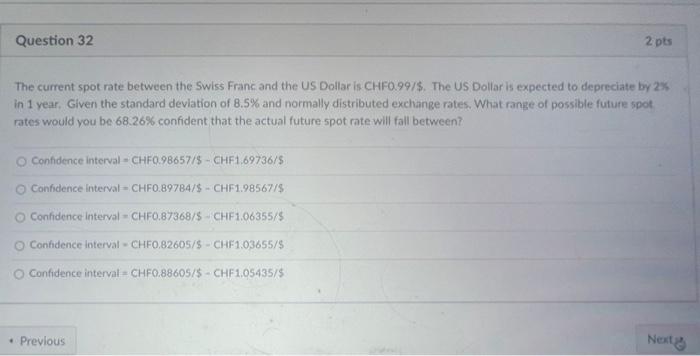

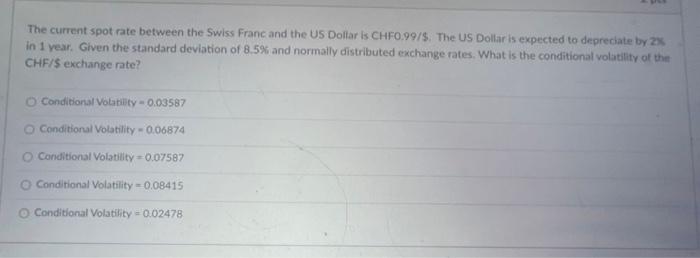

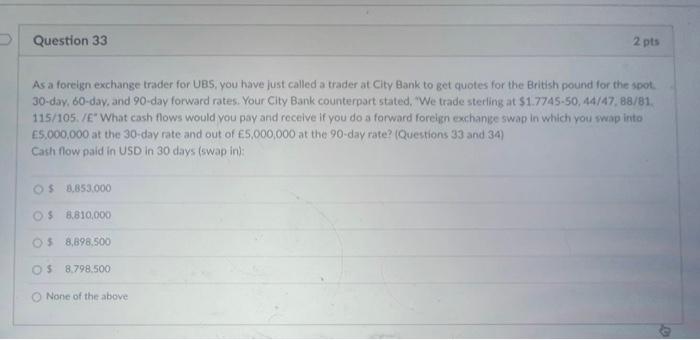

Question 30 2 pts The current spot rate between the Swiss Franc and the US Dollar is CHF0.99/5. The US Dollar is expected to depreciate by 2 in 1 year. Given the standard deviation of 8.5% and normally distributed exchange rates. What is the conditional mean of the CHF/S exchange rate? Conditional Mean - CHF0.9702/5 Conditional Mean - CHF01.0098/5 Conditional Mean - CHF0.9706/5 Conditional Mean - CHF0.9854/5 Conditional Mean CHF10074/5 Question 32 2 pts The current spot rate between the Swiss Franc and the US Dollar is CHF0.99/$. The US Dollar is expected to depreciate by 2% in 1 year. Given the standard deviation of 8.5% and normally distributed exchange rates. What range of possible future spot rates would you be 68.26% confident that the actual future spot rate will fall between? Confidence interval - CHF0.98657/9 - CHF1.69736/5 Confidence interval CHF0.897B4/$ - CHF1.98567/$ Confidence interval - CHF0.87368/6 CHF1.06355/5 Confidence interval - CHF0.82605/$ - CHF1.03655/5 Confidence interval = CHF0.8860575 - CHF1,05435/5 Previous Nexty The current spot rate between the Swiss Franc and the US Dollar is CHF0.997$. The US Dollar is expected to depreciate by 2x in 1 year. Given the standard deviation of 8.5% and normally distributed exchange rates. What is the conditional volatility of the CHF/S exchange rate? Conditional Volatility -0.03587 Conditional Volatility -0.06874 Conditional Volatility = 0.07587 Conditional Volatility -0.08415 Conditional Volatility = 0.02478 Question 33 2 pts As a foreign exchange trader for UBS, you have just called a trader at City Bank to get quotes for the British pound for the spot 30-day, 60-day, and 90-day forward rates. Your City Bank counterpart stated. "We trade sterling at $1.7745-50, 44/47, 88/81. 115/105/E" What cash flows would you pay and receive if you do a forward foreign exchange swap in which you swap into E5,000,000 at the 30-day rate and out of 5,000,000 at the 90-day rate? (Questions 33 and 34) Cash flow paid in USD in 30 days (swap in OS 3,853.000 OS 8.810,000 05 8,898,500 OS 8.798.500 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts