Question: QUESTION 30 2.5 points Save Answer This year, in 2019, Tammy files as a single taxpayer. Tammy received $42,700 of salary and paid $3,200 of

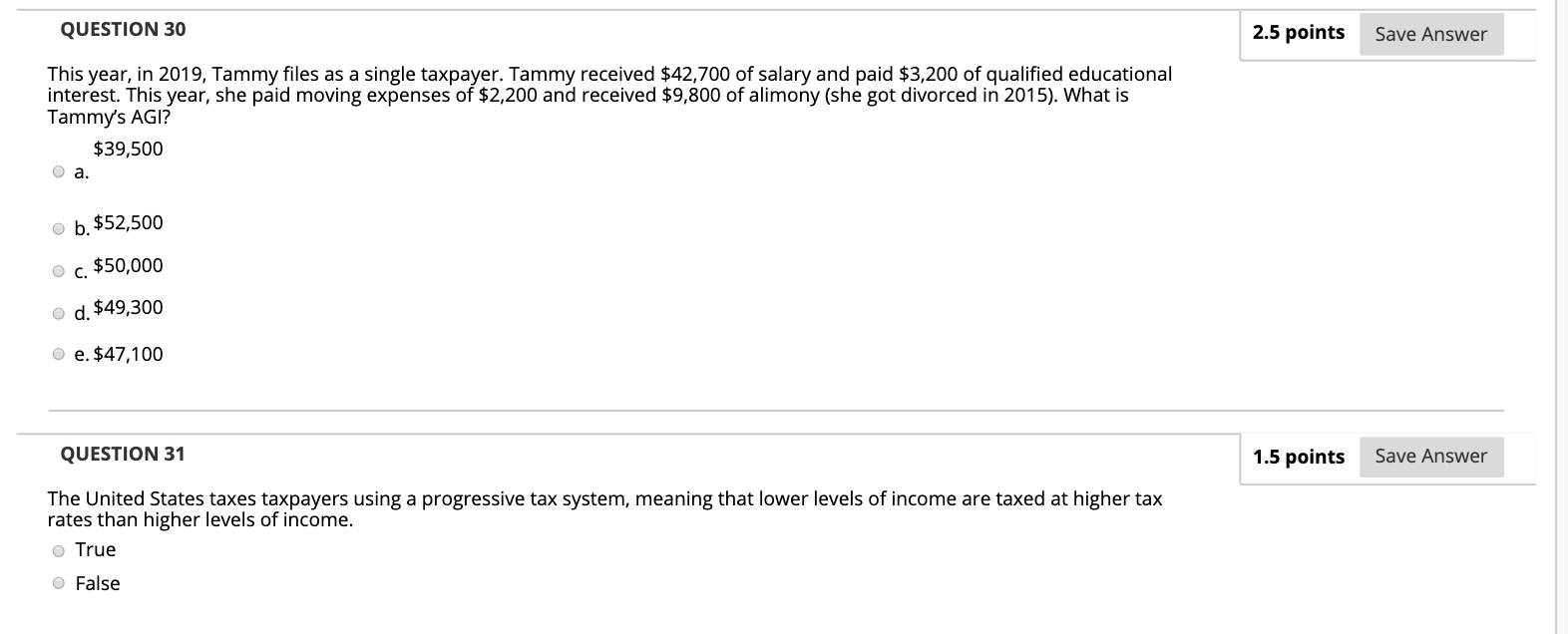

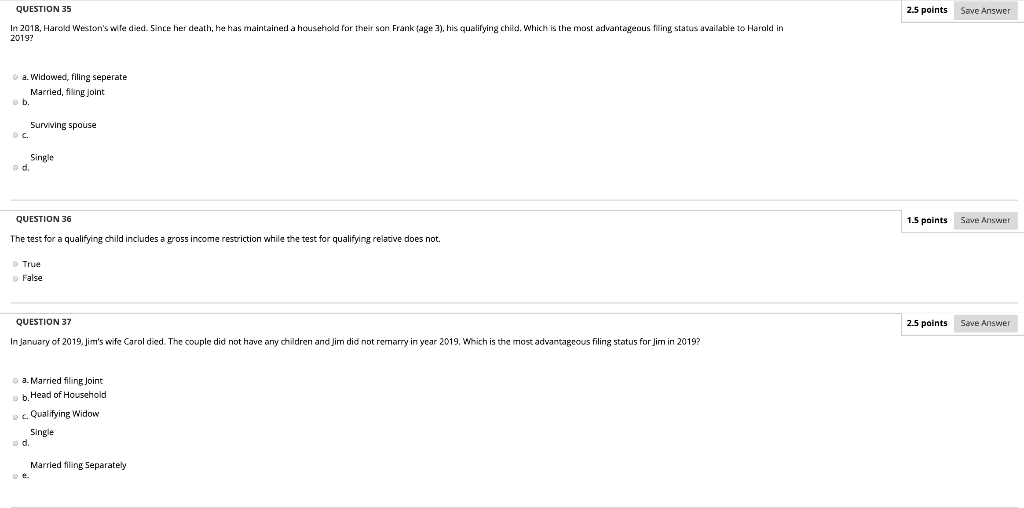

QUESTION 30 2.5 points Save Answer This year, in 2019, Tammy files as a single taxpayer. Tammy received $42,700 of salary and paid $3,200 of qualified educational interest. This year, she paid moving expenses of $2,200 and received $9,800 of alimony (she got divorced in 2015). What is Tammy's AGI? $39,500 a. ob. $52,500 c. $50,000 od. $49,300 o e. $47,100 QUESTION 31 1.5 points Save Answer The United States taxes taxpayers using a progressive tax system, meaning that lower levels of income are taxed at higher tax rates than higher levels of income. o True False QUESTION 35 2.5 points Save Answer In 2018, Harold Weston's wife died. Since her death, he has maintained a household for their son Frank (age 3), his qualifying child. Which is the most advantageous filing status available to Harold in 2019? a. Widowed, filing seperate Married, filing joint b. Surviving spouse Single d. QUESTION 36 1.5 points Save Answer The test for a qualifying child includes a gross income restriction while the test for qualifying relative does not True False QUESTION 37 2.5 points Save Answer In January of 2019. Jim's wife Carol died. The couple did not have any children and Jim did not remarry in year 2019. Which is the most advantageous filing status for Jim in 2019? a. Married filing Joint b. Head of Household c. Qualifying Widow Single Married filing Separately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts