Question: Question 30 (3 points) Listen If your $2,000 laptop is damaged in a fire, but you have an HO-3 policy, with a Section l-Coverage C

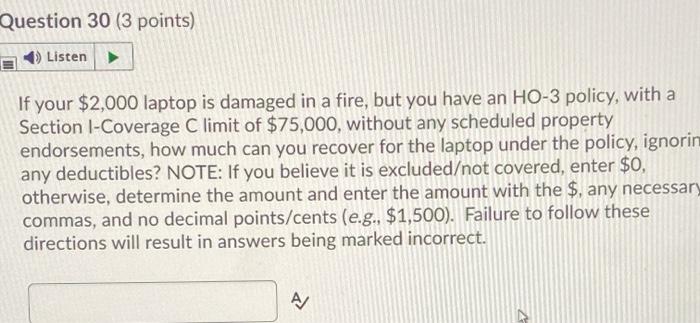

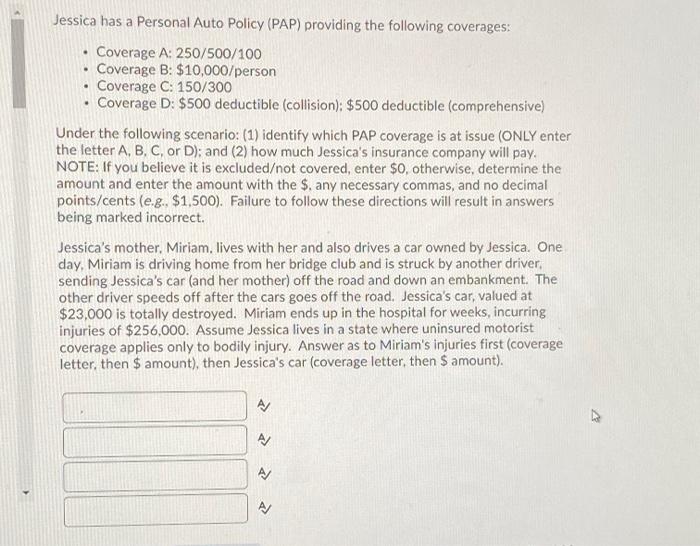

Question 30 (3 points) Listen If your $2,000 laptop is damaged in a fire, but you have an HO-3 policy, with a Section l-Coverage C limit of $75,000, without any scheduled property endorsements, how much can you recover for the laptop under the policy, ignorin any deductibles? NOTE: If you believe it is excludedot covered, enter $0, otherwise, determine the amount and enter the amount with the $, any necessary commas, and no decimal points/cents (e.g., $1,500). Failure to follow these directions will result in answers being marked incorrect. AM . . Jessica has a Personal Auto Policy (PAP) providing the following coverages: Coverage A: 250/500/100 Coverage B: $10,000/person Coverage C: 150/300 Coverage D: $500 deductible (collision): $500 deductible (comprehensive) Under the following scenario: (1) identify which PAP coverage is at issue (ONLY enter the letter A, B, C, or D): and (2) how much Jessica's insurance company will pay. NOTE: If you believe it is excludedot covered, enter $0, otherwise, determine the amount and enter the amount with the $. any necessary commas, and no decimal points/cents (e.g. $1,500). Failure to follow these directions will result in answers being marked incorrect. Jessica's mother, Miriam, lives with her and also drives a car owned by Jessica. One day, Miriam is driving home from her bridge club and is struck by another driver, sending Jessica's car (and her mother) off the road and down an embankment. The other driver speeds off after the cars goes off the road. Jessica's car, valued at $23,000 is totally destroyed. Miriam ends up in the hospital for weeks, incurring injuries of $256,000. Assume Jessica lives in a state where uninsured motorist coverage applies only to bodily injury. Answer as to Miriam's injuries first (coverage letter, then $ amount), then Jessica's car (coverage letter, then S amount). A N Question 30 (3 points) Listen If your $2,000 laptop is damaged in a fire, but you have an HO-3 policy, with a Section l-Coverage C limit of $75,000, without any scheduled property endorsements, how much can you recover for the laptop under the policy, ignorin any deductibles? NOTE: If you believe it is excludedot covered, enter $0, otherwise, determine the amount and enter the amount with the $, any necessary commas, and no decimal points/cents (e.g., $1,500). Failure to follow these directions will result in answers being marked incorrect. AM . . Jessica has a Personal Auto Policy (PAP) providing the following coverages: Coverage A: 250/500/100 Coverage B: $10,000/person Coverage C: 150/300 Coverage D: $500 deductible (collision): $500 deductible (comprehensive) Under the following scenario: (1) identify which PAP coverage is at issue (ONLY enter the letter A, B, C, or D): and (2) how much Jessica's insurance company will pay. NOTE: If you believe it is excludedot covered, enter $0, otherwise, determine the amount and enter the amount with the $. any necessary commas, and no decimal points/cents (e.g. $1,500). Failure to follow these directions will result in answers being marked incorrect. Jessica's mother, Miriam, lives with her and also drives a car owned by Jessica. One day, Miriam is driving home from her bridge club and is struck by another driver, sending Jessica's car (and her mother) off the road and down an embankment. The other driver speeds off after the cars goes off the road. Jessica's car, valued at $23,000 is totally destroyed. Miriam ends up in the hospital for weeks, incurring injuries of $256,000. Assume Jessica lives in a state where uninsured motorist coverage applies only to bodily injury. Answer as to Miriam's injuries first (coverage letter, then $ amount), then Jessica's car (coverage letter, then S amount). A N