Question: Question 30 (3 points) USE THE DATA BELOW TO ANSWER QUESTIONS 29, 30 AND 31 - THE DATA WILL BE REPEATED FOR EACH OF THE

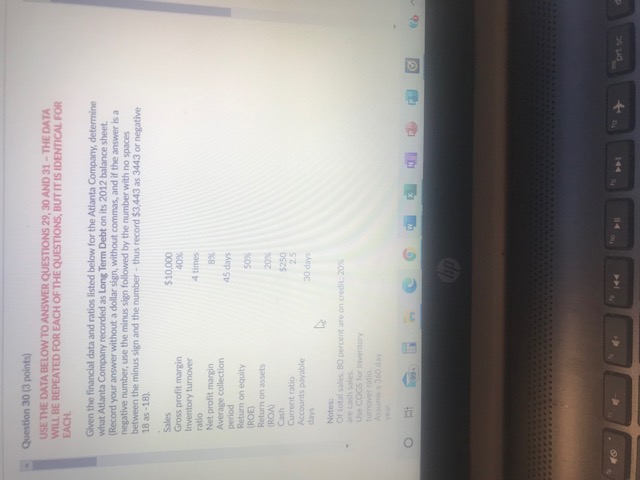

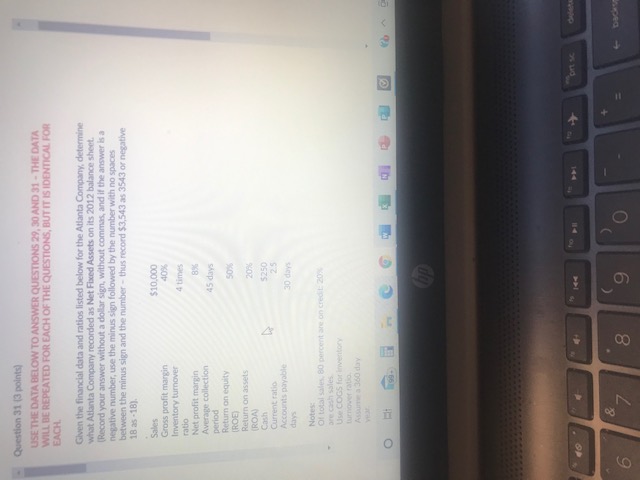

Question 30 (3 points) USE THE DATA BELOW TO ANSWER QUESTIONS 29, 30 AND 31 - THE DATA WILL BE REPEATED FOR EACH OF THE QUESTIONS, BUT IT IS IDENTICAL FOR EACH Given the financial data and ratios listed below for the Atlanta Company, determine what Atlanta Company recorded as Long Term Debt on its 2012 balance sheet. (Record your answer without a dollar sign, without commas, and if the answer is a negative number, use the minus sign followed by the number with no spaces between the minus sign and the number - thus record $3,443 as 3443 or negative 18 as -18) $10,000 40% 88 45 days Sales Gross profit margin Inventory turnover ratio Net profit margin Average collection period Return on equity (ROE Return on assets (ROA Cash Current ratio Accounts payable days 50% 20 $250 25 30 days Notes Of total 30 percentare on Credit: 20 are cashes Assume a 360 day on se Question 31 (3 points) USE THE DATA BELOW TO ANSWER QUESTIONS 29, 30 AND 31 - THE DATA WILL BE REPEATED FOR EACH OF THE QUESTIONS, BUT IT IS IDENTICAL FOR EACH Given the financial data and ratios listed below for the Atlanta Company, determine What Atlanta Company recorded as Net Fixed Assets on its 2012 balance sheet. (Record your answer without a dollar sign, without commas, and if the answer is a negative number, use the minus sign followed by the number with no spaces between the minus sign and the number - thus record $3,543 as 3543 or negative 18 as-18) $10.000 405 4 times 8 45 days Sales Gross profit margin Inventory turnover ratio Net profit margin Average collection period Return on equity CROE Return on assets ROA Cash Current ratio Accounts payable days 50 2011 5250 28 30 days Notes of total sales 80 percent are on credt 2000 Use COGS for inventory O 8. 6 & 7 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts