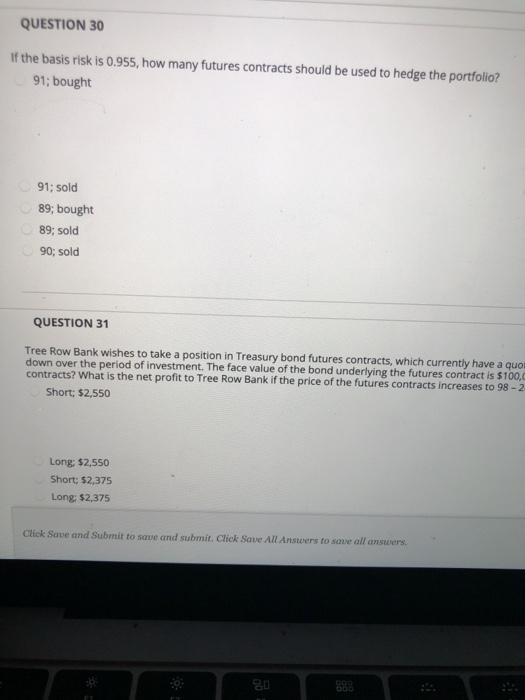

Question: . QUESTION 30 If the basis risk is 0.955, how many futures contracts should be used to hedge the portfolio? 91; bought 91: sold 89;

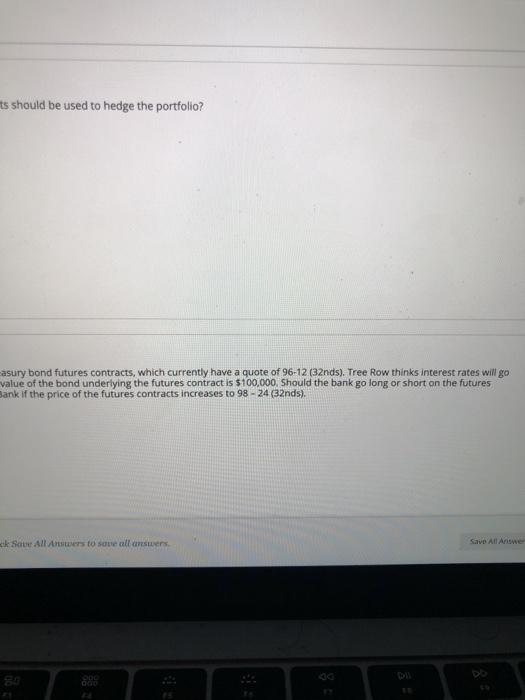

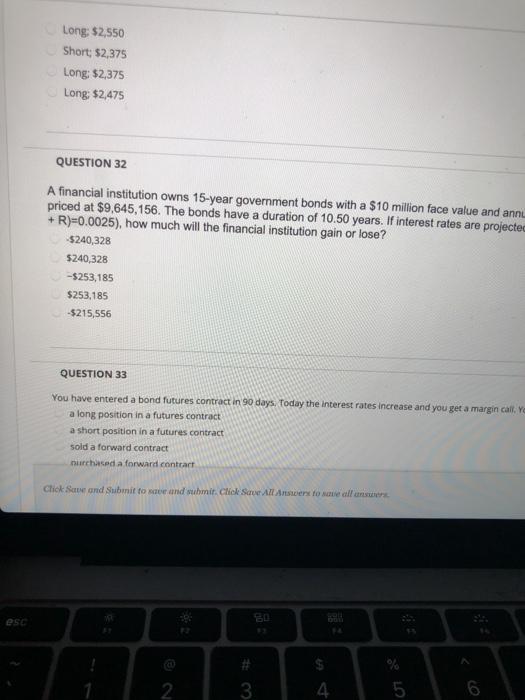

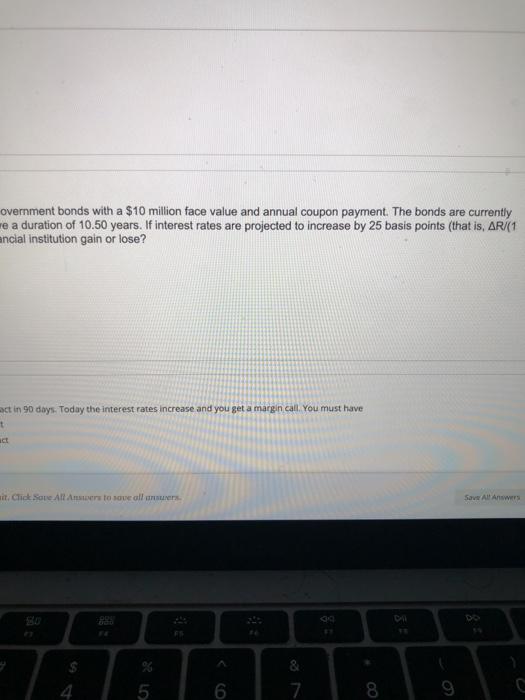

QUESTION 30 If the basis risk is 0.955, how many futures contracts should be used to hedge the portfolio? 91; bought 91: sold 89; bought 89; sold 90; sold QUESTION 31 Tree Row Bank wishes to take a position in Treasury bond futures contracts, which currently have a quo down over the period of investment. The face value of the bond underlying the futures contract is $100, contracts? What is the net profit to Tree Row Bank if the price of the futures contracts increases to 98 -2 Short: $2,550 Long: $2,550 Short: 52,375 Long: $2,375 Click Save and Submit to see and submit. Click Save All Aristers to see all answers its should be used to hedge the portfolio? asury bond futures contracts, which currently have a quote of 96-12 (32nds). Tree Row thinks interest rates will go value of the bond underlying the futures contract is $100,000. Should the bank golong or short on the futures Bank if the price of the futures contracts increases to 98 - 24 (32nds), ck Save All Answers to save all answers Save All Are SES Long: $2,550 Short; $2,375 Long: $2,375 Long: $2,475 QUESTION 32 A financial institution owns 15-year government bonds with a $10 million face value and annu priced at $9,645,156. The bonds have a duration of 10.50 years. If interest rates are projecte + R)=0.0025), how much will the financial institution gain or lose? -$240,328 $240,328 -$253,185 $253,185 -$215,556 QUESTION 33 You have entered a bond futures contract in 90 days. Today the Interest rates increase and you get a margin call. Ye a long position in a futures contract a short position in a futures contract sold a forward contract nurchased a forward contract Click Save and Submit to see and submit. Click Saor All Answers to see all under esc # 2 3 4 6 overnment bonds with a $10 million face value and annual coupon payment. The bonds are currently e a duration of 10.50 years. If interest rates are projected to increase by 25 basis points (that is, AR (1 ancial institution gain or lose? act in 90 days. Today the interest rates increase and you get a margin call You must have it. Click Save ANA to se aller Save All Answers 4 5 6 7 8 9 QUESTION 30 If the basis risk is 0.955, how many futures contracts should be used to hedge the portfolio? 91; bought 91: sold 89; bought 89; sold 90; sold QUESTION 31 Tree Row Bank wishes to take a position in Treasury bond futures contracts, which currently have a quo down over the period of investment. The face value of the bond underlying the futures contract is $100, contracts? What is the net profit to Tree Row Bank if the price of the futures contracts increases to 98 -2 Short: $2,550 Long: $2,550 Short: 52,375 Long: $2,375 Click Save and Submit to see and submit. Click Save All Aristers to see all answers its should be used to hedge the portfolio? asury bond futures contracts, which currently have a quote of 96-12 (32nds). Tree Row thinks interest rates will go value of the bond underlying the futures contract is $100,000. Should the bank golong or short on the futures Bank if the price of the futures contracts increases to 98 - 24 (32nds), ck Save All Answers to save all answers Save All Are SES Long: $2,550 Short; $2,375 Long: $2,375 Long: $2,475 QUESTION 32 A financial institution owns 15-year government bonds with a $10 million face value and annu priced at $9,645,156. The bonds have a duration of 10.50 years. If interest rates are projecte + R)=0.0025), how much will the financial institution gain or lose? -$240,328 $240,328 -$253,185 $253,185 -$215,556 QUESTION 33 You have entered a bond futures contract in 90 days. Today the Interest rates increase and you get a margin call. Ye a long position in a futures contract a short position in a futures contract sold a forward contract nurchased a forward contract Click Save and Submit to see and submit. Click Saor All Answers to see all under esc # 2 3 4 6 overnment bonds with a $10 million face value and annual coupon payment. The bonds are currently e a duration of 10.50 years. If interest rates are projected to increase by 25 basis points (that is, AR (1 ancial institution gain or lose? act in 90 days. Today the interest rates increase and you get a margin call You must have it. Click Save ANA to se aller Save All Answers 4 5 6 7 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts