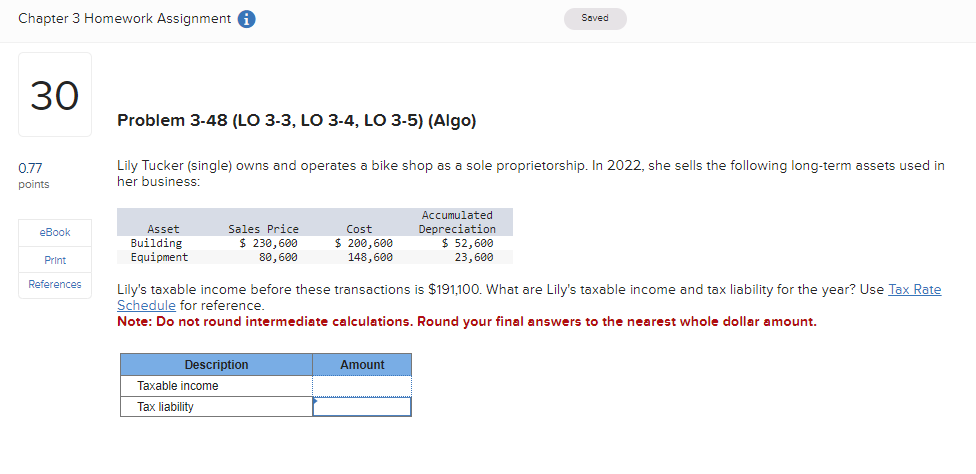

Question: Question 30 Problem 3-48 (LO 3-3, LO 3-4, LO 3-5) (Algo) Lily Tucker (single) owns and operates a bike shop as a sole proprietorship. In

Question 30

Question 30

Problem 3-48 (LO 3-3, LO 3-4, LO 3-5) (Algo) Lily Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2022, she sells the following long-term assets used in her business: Lily's taxable income before these transactions is $191,100. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts