Question: question 30 question 34 question 44 The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the

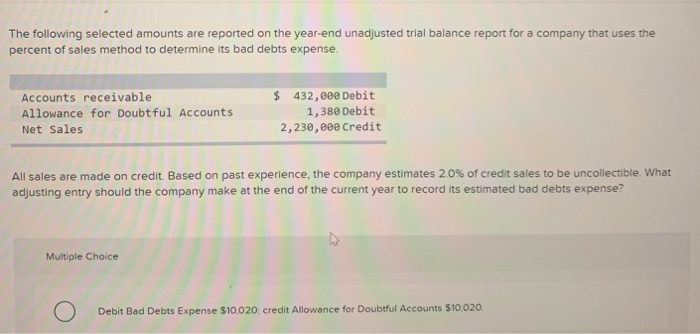

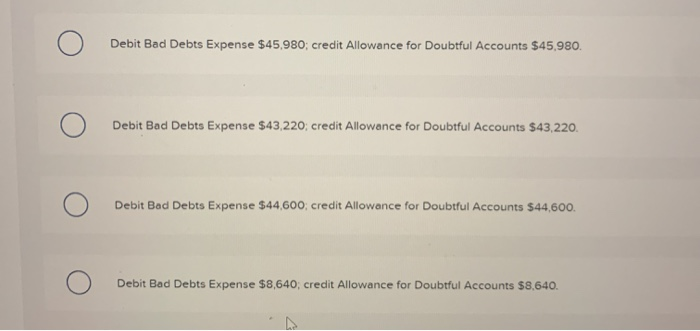

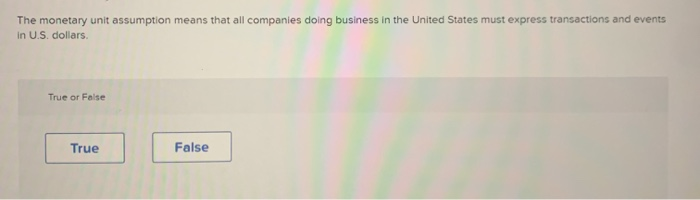

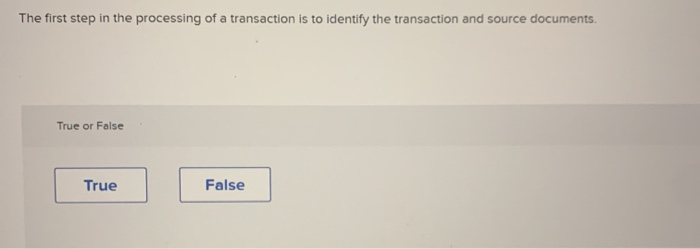

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense. Accounts receivable Allowance for Doubtful Accounts Net Sales $ 432,000 Debit 1,380 Debit 2,230,000 Credit All sales are made on credit. Based on past experience, the company estimates 20% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense? Multiple Choice Debit Bad Debts Expense $10.020, credit Allowance for Doubtful Accounts $10.020. | Debit Bad Debts Expense $45.980; credit Allowance for Doubtful Accounts $45,980. O Debit Bad Debts Expense $43,220; credit Allowance for Doubtful Accounts $43,220 Debit Bad Debts Expense $44,600, credit Allowance for Doubtful Accounts $44,600. Debit Bad Debts Expense $8,640, credit Allowance for Doubtful Accounts 58.640. The monetary unit assumption means that all companies doing business in the United States must express transactions and events in U.S. dollars True or False True False The first step in the processing of a transaction is to identify the transaction and source documents. True or False True True ] [ False False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts