Question: Question # 30: Show work please E. term is 25 years. 28. interest rate is 5%. 29. Find the present value of a 10-year ordinary

Question # 30:

Show work please

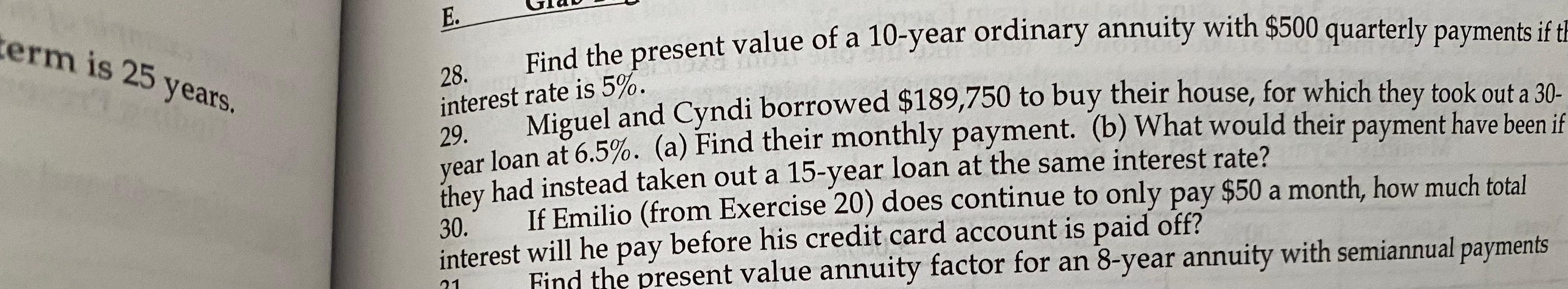

E. term is 25 years. 28. interest rate is 5%. 29. Find the present value of a 10-year ordinary annuity with $500 quarterly payments if Miguel and Cyndi borrowed $189,750 to buy their house, for which they took out a 30- vear loan at 6.5%. (a) Find their monthly payment. (b) What would their payment have been it they had instead taken out a 15-year loan at the same interest rate? If Emilio (from Exercise 20) does continue to only pay $50 a month, how much total interest will he pay before his credit card account is paid off? Find the present value annuity factor for an 8-year annuity with semiannual payments a 30. 21 E. term is 25 years. 28. interest rate is 5%. 29. Find the present value of a 10-year ordinary annuity with $500 quarterly payments if Miguel and Cyndi borrowed $189,750 to buy their house, for which they took out a 30- vear loan at 6.5%. (a) Find their monthly payment. (b) What would their payment have been it they had instead taken out a 15-year loan at the same interest rate? If Emilio (from Exercise 20) does continue to only pay $50 a month, how much total interest will he pay before his credit card account is paid off? Find the present value annuity factor for an 8-year annuity with semiannual payments a 30. 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts