Question: QUESTION 30 Which statement is correct? A. Losses incurred in the sale or exchange of personal-use property are deductible as capital losses. B. Tax deductions

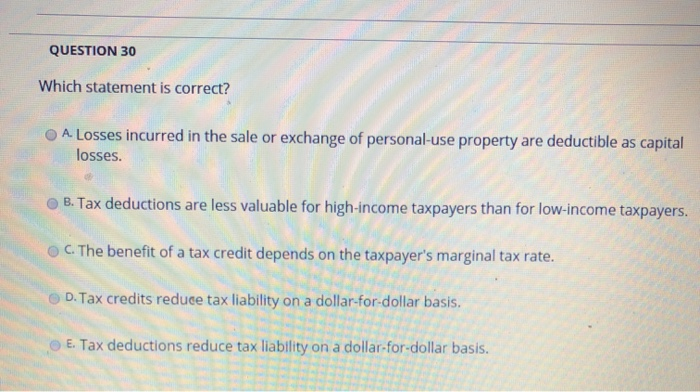

QUESTION 30 Which statement is correct? A. Losses incurred in the sale or exchange of personal-use property are deductible as capital losses. B. Tax deductions are less valuable for high-income taxpayers than for low-income taxpayers. C. The benefit of a tax credit depends on the taxpayer's marginal tax rate. D. Tax credits reduce tax liability on a dollar-for-dollar basis. E. Tax deductions reduce tax liability on a dollar-for-dollar basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts