Question: > Question 31 2 pts Shown below is information that Larry received for this year relative to his ownership interest as a partner in QSR

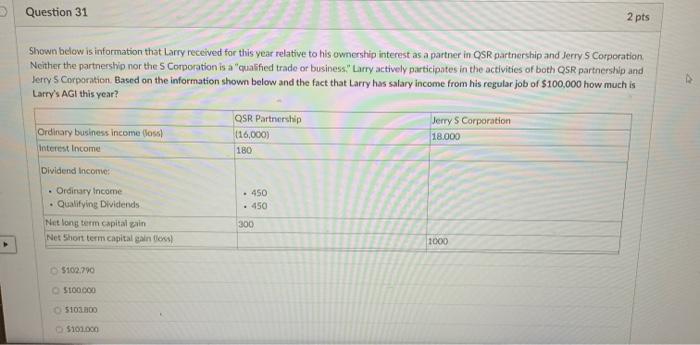

> Question 31 2 pts Shown below is information that Larry received for this year relative to his ownership interest as a partner in QSR partnership and Jerry S Corporation Neither the partnership nor the Corporation is a qualified trade or business." Larry actively participates in the activities of both QSR partnership and Jerry Corporation. Based on the information shown below and the fact that Larry has salary income from his regular job of $100,000 how much is Larry's AG this year? OSR Partnership Jerry S Corporation Ordinary business income (oss 116,000) 18.000 Interest Income 180 Dividend Income: 450 .450 Ordinary Income Qualifying Dividends Net long term capital in Net Short term capital gains 300 1000 $102.790 $100.000 5103.00 $100.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts