Question: Question 31 (6 points) Reporting and Analyzing Long Lived Assets - Depreciation (approx. 15 minutes) Chili Mealy Ltd. purchased a packaging machinery for their ready-made

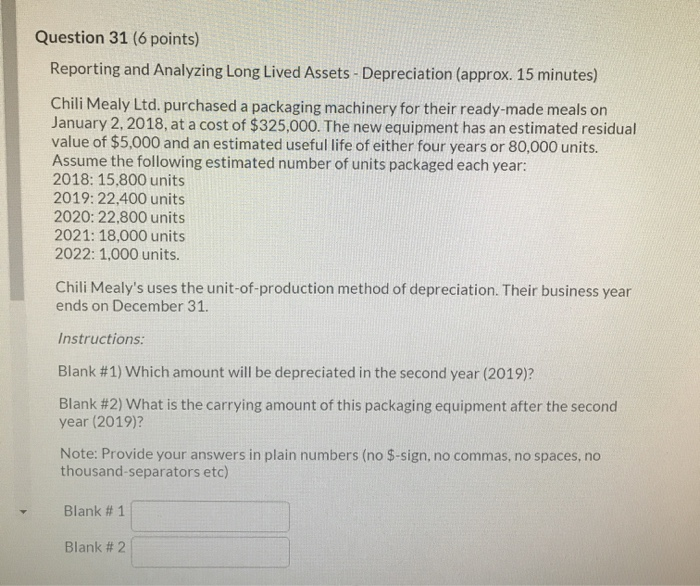

Question 31 (6 points) Reporting and Analyzing Long Lived Assets - Depreciation (approx. 15 minutes) Chili Mealy Ltd. purchased a packaging machinery for their ready-made meals on January 2, 2018, at a cost of $325,000. The new equipment has an estimated residual value of $5,000 and an estimated useful life of either four years or 80,000 units. Assume the following estimated number of units packaged each year: 2018: 15,800 units 2019: 22,400 units 2020:22,800 units 2021: 18,000 units 2022: 1,000 units. Chili Mealy's uses the unit-of-production method of depreciation. Their business year ends on December 31. Instructions: Blank #1) Which amount will be depreciated in the second year (2019) Blank #2) What is the carrying amount of this packaging equipment after the second year (2019) Note: Provide your answers in plain numbers (no $-sign, no commas, no spaces, no thousand-separators etc) Blank # 1 Blank #2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts