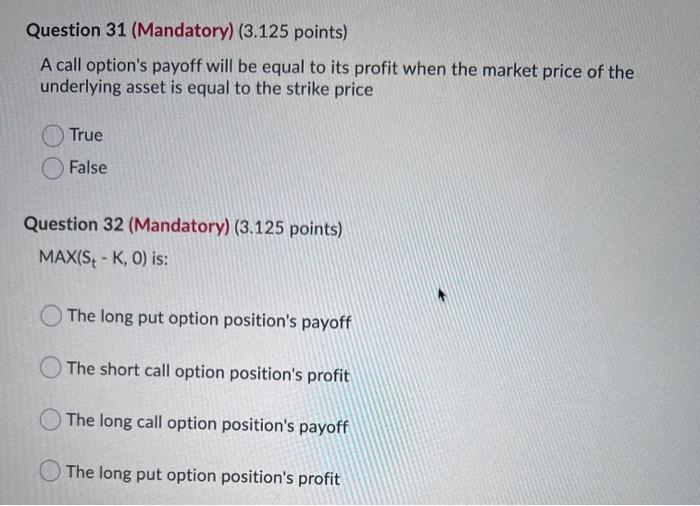

Question: Question 31 (Mandatory) (3.125 points) A call option's payoff will be equal to its profit when the market price of the underlying asset is equal

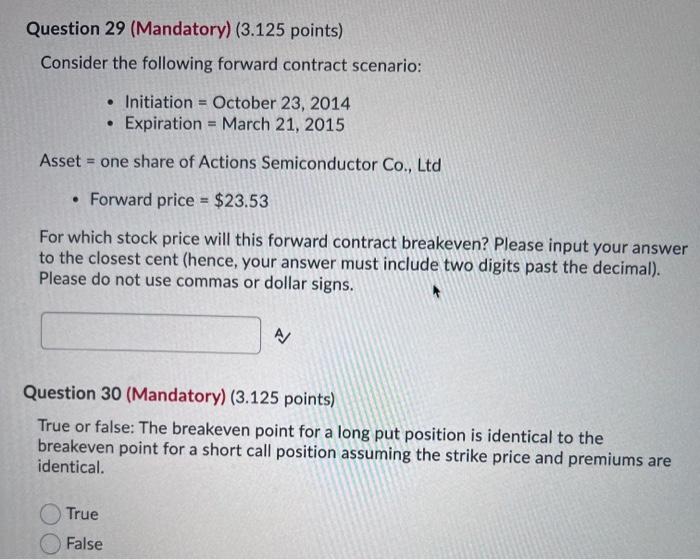

Question 31 (Mandatory) (3.125 points) A call option's payoff will be equal to its profit when the market price of the underlying asset is equal to the strike price True False Question 32 (Mandatory) (3.125 points) MAXIS - K, 0) is: The long put option position's payoff The short call option position's profit The long call option position's payoff The long put option position's profit Question 29 (Mandatory) (3.125 points) Consider the following forward contract scenario: Initiation = October 23, 2014 Expiration = March 21, 2015 Asset = one share of Actions Semiconductor Co., Ltd Forward price = $23.53 For which stock price will this forward contract breakeven? Please input your answer to the closest cent (hence, your answer must include two digits past the decimal). Please do not use commas or dollar signs. A/ Question 30 (Mandatory) (3.125 points) True or false: The breakeven point for a long put position is identical to the breakeven point for a short call position assuming the strike price and premiums are identical. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts