Question: Question 31 mark On 1 July 20X2, Sub Ltd sold an item of plant to Parent Ltd for $30 000. The plant had cost Sub

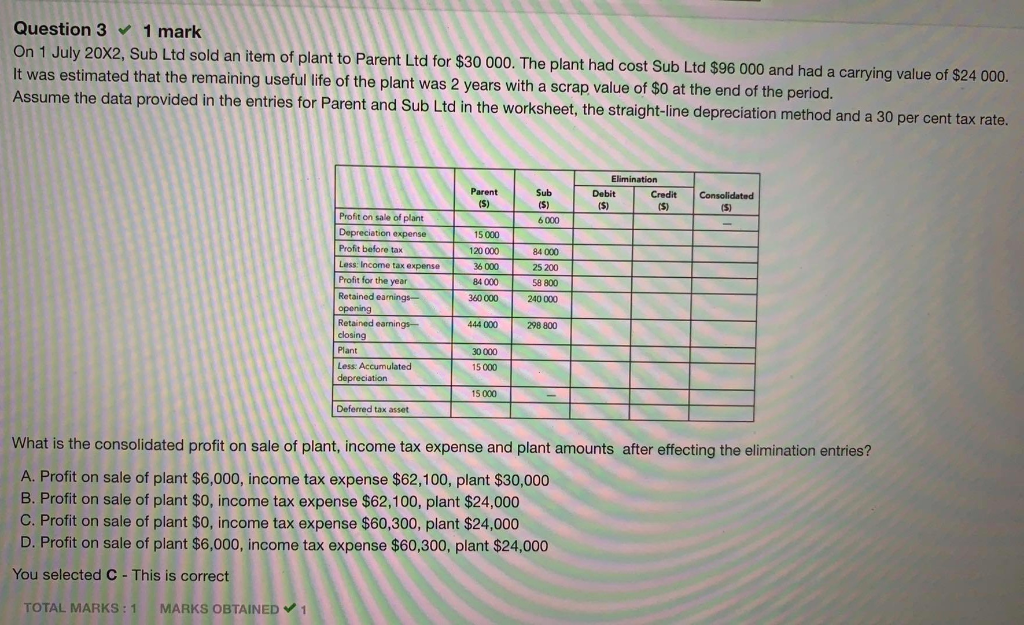

Question 31 mark On 1 July 20X2, Sub Ltd sold an item of plant to Parent Ltd for $30 000. The plant had cost Sub Ltd $96 000 and had a carrying value of $24 000. It was estimated that the remaining useful life of the plant was 2 years with a scrap value of $0 at the end of the period. Assume the data provided in the entries for Parent and Sub Ltd in the worksheet, the straight-line depreciation method and a 30 per cent tax rate. Parent (5) Sub ($) 6 000 Elimination Debit Credit (S) ($) Consolidated (5) Profit on sale of plant Depreciation expense Profit before tax Less: Income tax expense Profit for the year Retained earnings opening Retained earnings- closing Plant Less: Accumulated depreciation 15 000 120 000 36 000 84 000 360 000 84 000 25 200 58 800 240 000 444 000 298 800 30 000 15 000 15 000 Deferred tax asset What is the consolidated profit on sale of plant, income tax expense and plant amounts after effecting the elimination entries? A. Profit on sale of plant $6,000, income tax expense $62,100, plant $30,000 B. Profit on sale of plant $0, income tax expense $62,100, plant $24,000 C. Profit on sale of plant $0, income tax expense $60,300, plant $24,000 D. Profit on sale of plant $6,000, income tax expense $60,300, plant $24,000 You selected C - This is correct TOTAL MARKS: 1 MARKS OBTAINED V1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts