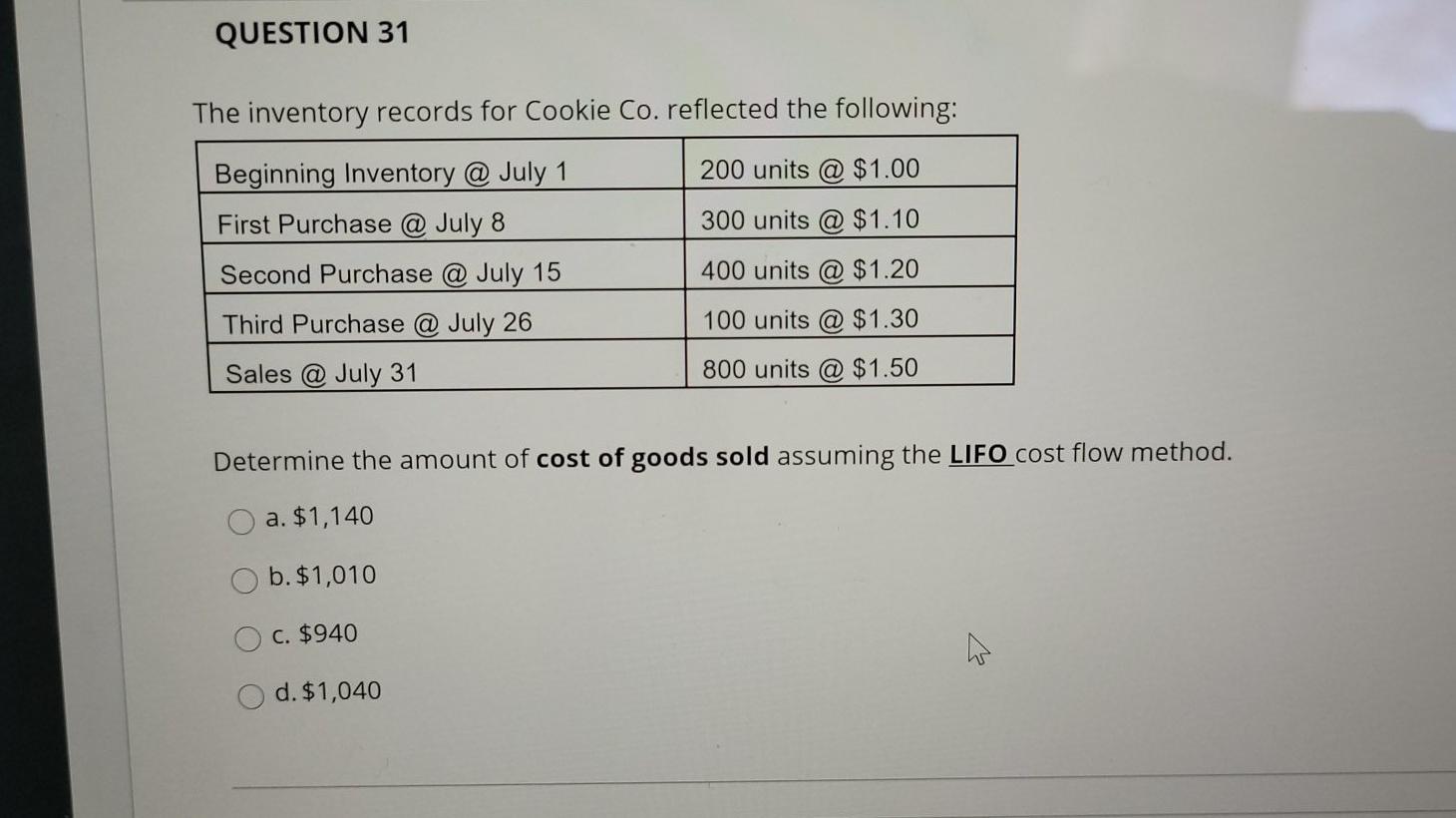

Question: QUESTION 31 The inventory records for Cookie Co. reflected the following: 200 units @ $1.00 300 units @ $1.10 Beginning Inventory @ July 1 First

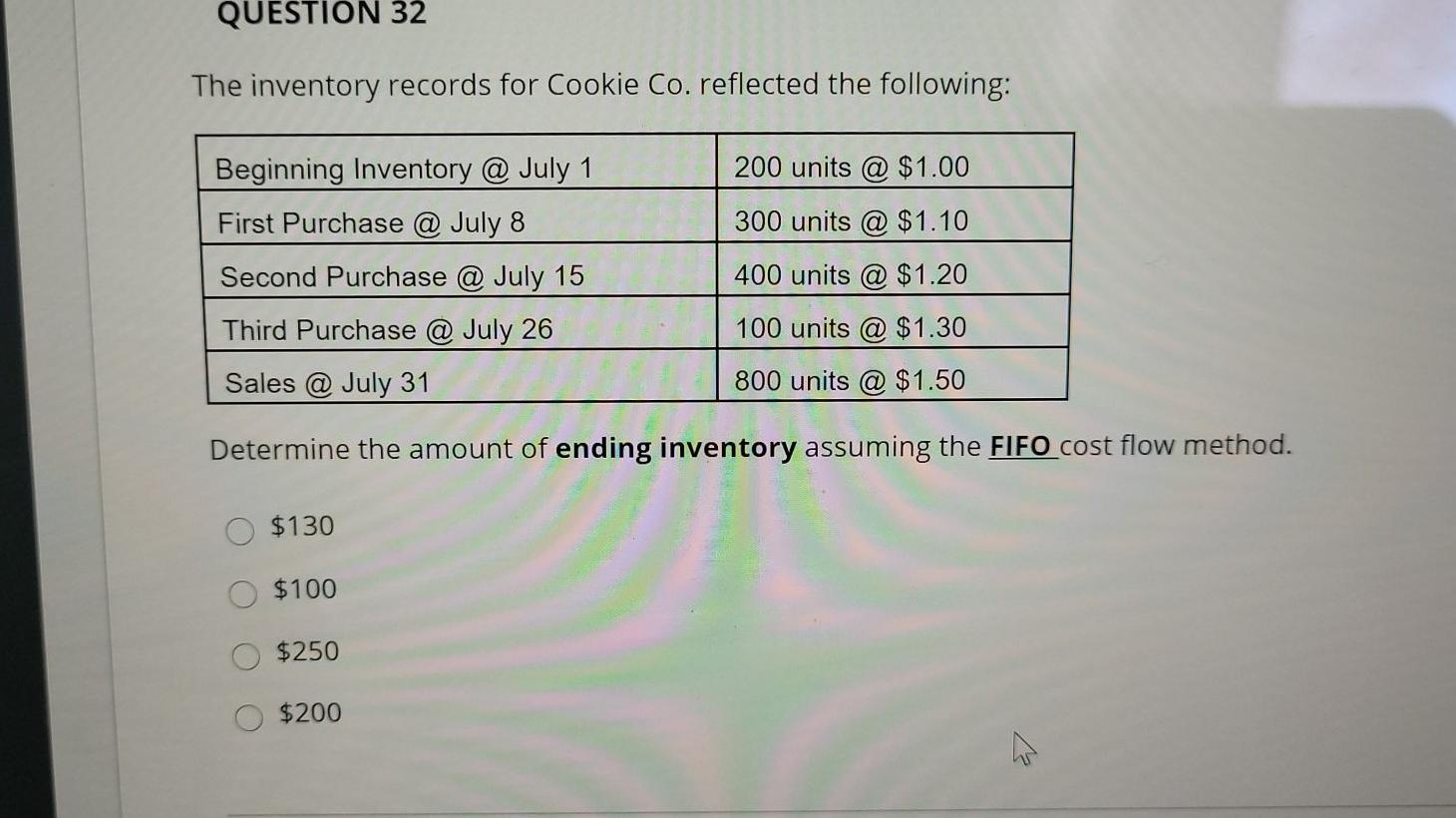

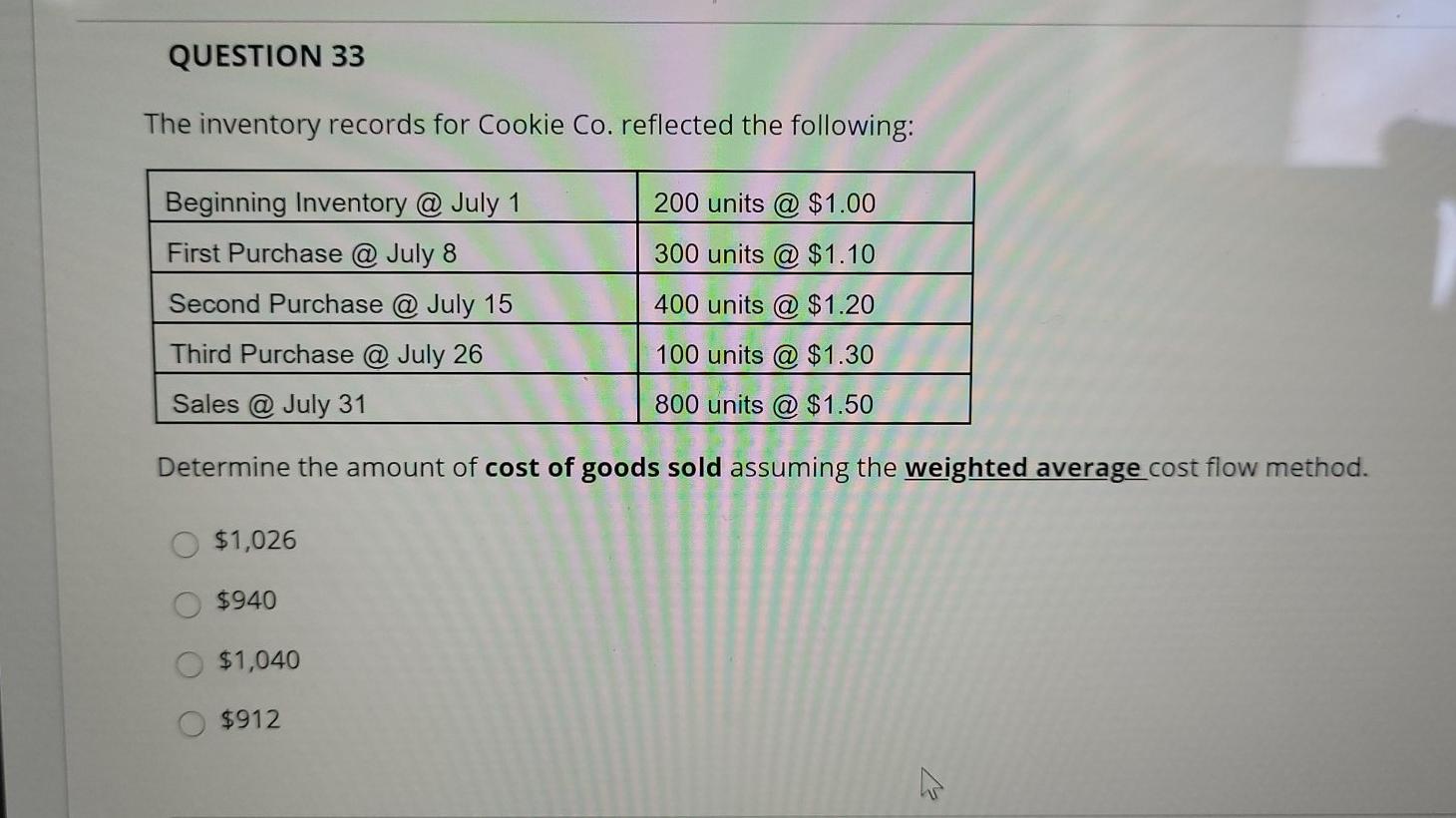

QUESTION 31 The inventory records for Cookie Co. reflected the following: 200 units @ $1.00 300 units @ $1.10 Beginning Inventory @ July 1 First Purchase @ July 8 Second Purchase @ July 15 Third Purchase @ July 26 Sales @ July 31 400 units @ $1.20 100 units @ $1.30 800 units @ $1.50 Determine the amount of cost of goods sold assuming the LIFO cost flow method. a. $1,140 b.$1,010 C. $940 d. $1,040 QUESTION 32 The inventory records for Cookie Co. reflected the following: 200 units @ $1.00 Beginning Inventory @ July 1 First Purchase @ July 8 Second Purchase @ July 15 300 units @ $1.10 400 units @ $1.20 Third Purchase @ July 26 100 units @ $1.30 Sales @ July 31 800 units @ $1.50 Determine the amount of ending inventory assuming the FIFO cost flow method. $130 $100 $250 $200 QUESTION 33 The inventory records for Cookie Co. reflected the following: 200 units @ $1.00 300 units @ $1.10 Beginning Inventory @ July 1 First Purchase @ July 8 Second Purchase @ July 15 Third Purchase @ July 26 Sales @ July 31 400 units @ $1.20 100 units @ $1.30 800 units @ $1.50 Determine the amount of cost of goods sold assuming the weighted average cost flow method. $1,026 $940 $1,040 $912 NO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts