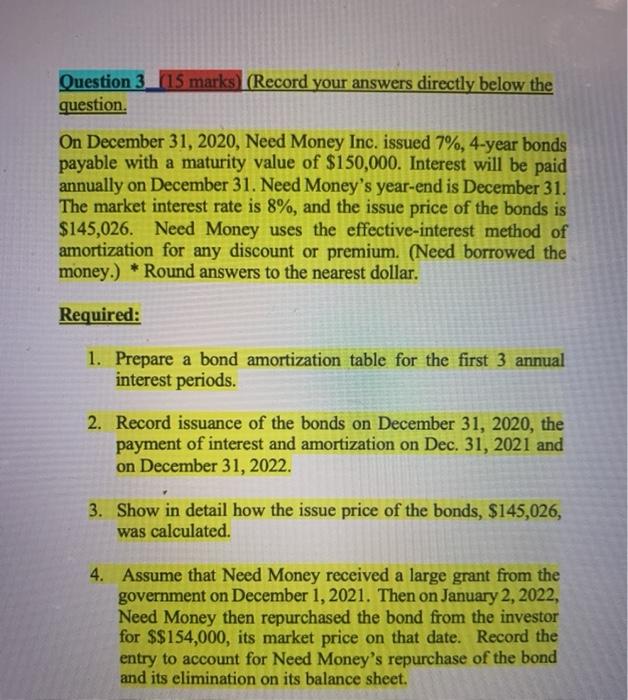

Question: Question 315 marks (Record your answers directly below the question On December 31, 2020, Need Money Inc. issued 7%, 4-year bonds payable with a maturity

Question 315 marks (Record your answers directly below the question On December 31, 2020, Need Money Inc. issued 7%, 4-year bonds payable with a maturity value of $150,000. Interest will be paid annually on December 31. Need Money's year-end is December 31. The market interest rate is 8%, and the issue price of the bonds is $145,026. Need Money uses the effective-interest method of amortization for any discount or premium. (Need borrowed the money.) * Round answers to the nearest dollar. Required: 1. Prepare a bond amortization table for the first 3 annual interest periods. 2. Record issuance of the bonds on December 31, 2020, the payment of interest and amortization on Dec. 31, 2021 and on December 31, 2022. 3. Show in detail how the issue price of the bonds, $145,026, was calculated. 4. Assume that Need Money received a large grant from the government on December 1, 2021. Then on January 2, 2022, Need Money then repurchased the bond from the investor for $$154,000, its market price on that date. Record the entry to account for Need Money's repurchase of the bond and its elimination on its balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts