Question: Question 3-16. The solution needs to be created using excel Debbie Gibson is considering three investment options for a small inheritance that she has just

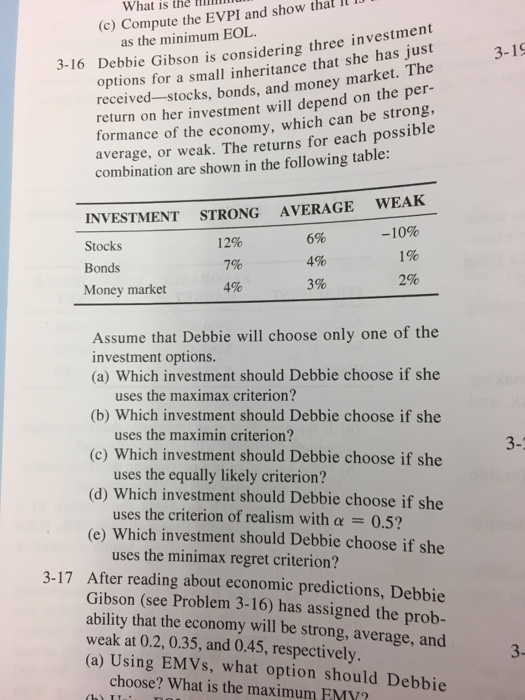

Debbie Gibson is considering three investment options for a small inheritance that she has just received-stocks, bonds, and money market. The received on her investments will depend on the performance of the economy, which can be strong, average, or weak. The returns for each possible combination are shown in the following table: Assume that Debbie will choose only one of the investment options. Which investment should Debbie choose if she uses the maximax criterion? Which investment should Debbie choose if she uses the maximin criterion? Which investment should Debbie choose if she uses the equally likely criterion? which investment should Debbie choose if she uses the criterion of realism with alpha = 0.5? Which investment should Debbie choose if she uses the minimax regret criterion? After reading about economic predictions, Debbie Gibson (see Problem 3-16) has assigned the probability that the economy will be strong, average, and weak at 0.2, 0.35, and 0.45, respectively. Using EMVs, option should Debbie choose? What is the maximum EMV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts